Contents

- Enhancement to the Goods Vehicle Movement Service (GVMS)

- New Certificates Exchange System (CERTEX) for licensed goods goes live on 15 September 2025

- Confirmation of the new ICS2 mandatory adoption date

- Upcoming TSS Portal update: new data field for ICS2

- Reducing error messages and Trader Input Required (TIRs) when moving controlled goods using TSS

- Using XI EORIs through the Trader Support Service

- Information to help you resolve error codes: Error code CDS40011

- When does the Supplementary Declaration need to be completed?

Enhancement to the Goods Vehicle Movement Service (GVMS)

On 1 September 2025, HMRC introduced an enhancement to GVMS that allows users to add up to 2,500 standalone Entry Summary (ENS) references to a Goods Movement Reference (GMR).

A new ‘Section 4: safety and security requirements’ is now available, where the multiple ENS references can be added.

This enhancement will not impact the current capability to add individual ENS references linked to declarations if customers choose to do so.

Please note that the existing requirement to supply a non ENS declaration for a movement containing goods still applies.

GVMS Haulier API users will also be able to add up to 2,500 standalone ENS references.

More information can be found in Create a goods movement reference on GOV.UK.

New Certificates Exchange System (CERTEX) for licensed goods goes live on 15 September 2025

From 15 September 2025, licence data on Northern Ireland declarations will be verified by a new Certificates Exchange System (CERTEX), which is replacing the previous Automatic Licence Verification System (ALVS) for Northern Ireland. With the introduction of CERTEX, electronic documents raised on systems such as TRACES NT will be verified by CERTEX.

CERTEX verifications apply to the following certificates:

| Certificate Type | Certificate Type Detail | Document Code |

| CHED-A | Live Animals | C640 |

| CHED-P | Products of Animal Origin | N853 |

| CHED-D | Food and Feed of Non-Animal Origin | C678 |

| CHED-PP | Plant and Plant Products | C085 |

| Certificate of Inspection – COI | Certificate of Organic Conformity | C644 |

| F-GAS – Import Only | Fluorinated Gases | Y986, Y123, Y124, Y120, Y951, C057, C079, C082 |

| O-Zone Depleting Substances – ODS | O-Zone Depleting Substance | L100 |

What are the changes?

Common Health Entry Document (CHED) reference format

The format of the CHED reference number on Northern Ireland declarations will be changing in line with CERTEX requirements. The CHED reference number on Northern Ireland declarations must be provided in the following format: letters followed by numbers including the full stop character. For example: CHEDA.XX.20YY.nnnnnnn, where XX is the country of issuance, YY is the year, and nnnnnnn is the number (seven digits), (Optional suffix ‘V’). Examples of this would be CHEDA.XI.2024.1234567 or CHEDA.XI.2024.1234567V.

You must ensure that your pre-lodged declarations have the correct format and document codes. If not, you will need to amend and resubmit.

Please check Appendix 5A on GOV.UK, which has been updated to reflect changes of the CHED format as well as declaration completion instructions for all other Document References associated with Northern Ireland declarations.

Additional Document Code required for plant and plant products (CHED.PP licences)

Under CERTEX, Document Code C085, which refers to the Common Health Entry Document for Plants and Plant Products (CHED-PP), becomes mandatory and must also be declared when either Document Code N002 (Conformity Certificate) or N851 (Phytosanitary Certificate) is declared.

What does this mean for TSS users?

Traders moving goods to Northern Ireland must make sure the information provided on their declaration matches the information on the relevant licence or certification, such as licence reference number, commodity code, net mass, and supplementary units (where applicable).

Traders moving plant and plant products (CHED-PP) need to add additional Document Code C085 to their declaration, in addition to N002 (Conformity Certificate) or N851 (Phytosanitary Certificate).

This applies for all licence types mentioned above on your Simplified Frontier Declaration, Full Frontier Declaration, Internal Market Movement Information and Supplementary Declaration.

Any queries raised by CERTEX will be received in TSS as a Customs Declaration Service (CDS) declaration response, with the pre-fix ‘CERTEX’ followed by query explanatory text.

The status of the declaration in TSS, which is subject to a CERTEX query, will change to ‘Amendment Required’ at consignment level and ‘Trader Input Required’ at header level. TSS will inform you via email that an amendment is required due to a CERTEX query. You will then need to make the necessary amendments in response to the CERTEX query and resubmit your declaration.

If the information on your declaration does not match your licence, then your goods may be subject to a hold or may need to be reported for inspection upon arrival in Northern Ireland.

The Goods Vehicle Movement Service (GVMS) messaging service will notify the haulier which Department of Agriculture, Environment and Rural Affairs (DAERA) or Border Force facility to report to when required.

If you need help with the declaration amendments related to a CERTEX query, please contact the Trader Support Service.

For more guidance on CERTEX including how to complete specific information on your declarations, see Moving licensed goods into or out of Northern Ireland on GOV.UK

Confirmation of the new ICS2 mandatory adoption date

HMRC recently confirmed that those traders who need more time to prepare to move to ICS2 will be able to submit Entry Summary Declarations (ENS) via Import Control System Northern Ireland (ICS-NI) for movements until 31 December 2025. Traders should continue to work with their supply chain now to make sure they’re ready for ICS2 as soon as possible and no later than 31 December 2025.

As a Trader Support Service (TSS) user, you can continue to submit Entry Summary Declarations (ENS) using ICS-NI or the new ICS2 dataset if ready to do so. For movements from 1 January 2026 the new ICS2 dataset will become mandatory for all TSS users. You don’t need to register to use ICS2, as we will do this for you.

Upcoming TSS Portal update: new data field for ICS2

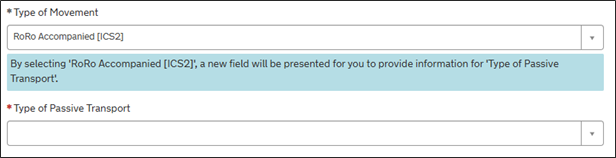

TSS Portal users will soon be presented with a new data field when completing data for the Entry Summary Declaration (ENS) via ICS2. The new field is currently scheduled to be implemented on 5 October 2025 and refers to Type of Movement and Type of Passive Transport.

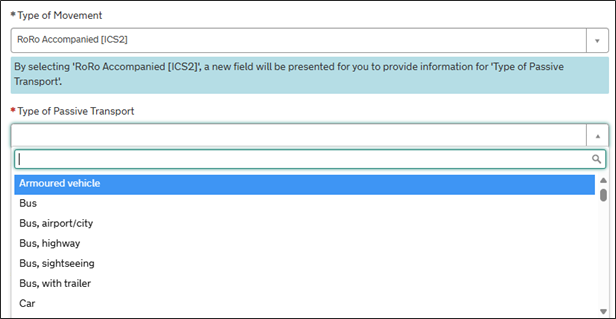

If the user sets the Type of Movement to ‘RoRo Accompanied’, they will see a mandatory Type of Passive Transport drop-down menu.

What is Passive Transport?

The term ‘Passive Transport’ relates to how the goods were transported onto the ferry/ship and removed from the ferry/ship into Northern Ireland if they are ‘Accompanied’.

In simple terms this refers to the type of truck, van or lorry moving the goods. For example, a curtain-sided truck or a truck with a curtain-sided trailer would be best described as ‘Truck, Tautliner’ as the Type of Passive Transport. There are also options available for refrigerated transporters. Please familiarise yourself with the list when it becomes available so you can make the most appropriate choice.

Does this apply to all ENS submissions via ICS2?

No, the additional data will only apply if ‘RoRo Accompanied [ICS2]’ is selected as the Type of Movement.

Reducing error messages and Trader Input Required (TIRs) when moving controlled goods using TSS

Errors in manual input of movement information can cause delays with processing and may affect your declaration submissions, particularly when you need a licence or document such as a Common Health Entry Document (CHED).

The Customs Declaration Service (CDS) will check that the information entered on the TSS Portal matches your licence details. If the information doesn’t match, then it will return a Trader Input Required (TIR) error which you will need to correct before the goods move.

You can increase first time acceptance of your movements and avoid any delays by checking that your licence information matches your movement on TSS.

Does the following on TSS match your licence or CHED?

- Commodity codes

- Weights

- Quantities

- CHED or licence information, and that it is the correct format that CDS requires

If you have many lines of commodities in one CHED or many CHEDs in one declaration, check these carefully before you submit.

What is a CHED?

- A notification of imports of food, feed, and plants to authorities

- Submitted in advance of good arriving in Northern Ireland

- Supports biosecurity (through checks at the border for some goods) and traceability of foodstuffs

CHED references are provided in customs import declarations. An example of a CHED reference is ‘CHEDA.XI.2024.1234567V’.

What are controlled goods?

Controlled goods are those that require additional licences, documentation, or authorisations to be provided before being moved from GB to NI. Some common examples are:

- Excise goods

- Goods requiring export licences

- Common Agricultural Policy (CAP) goods

For more information, please visit the Guidance on controlled goods and the Online Tariff Tool on NICTA.

Using XI EORIs through the Trader Support Service

The TSS Portal accepts XI EORIs

HMRC’s Customs Declaration Service (CDS), to which information is submitted from the TSS Portal, provides the functionality to use XI EORIs. Therefore, you need to use your XI EORI when making declarations for goods movements into and out of Northern Ireland.

Steps you need to take:

- Make sure your company profile in TSS is updated with the correct XI EORI number and its related authorisations, for example, UKIMS authorisation.

- Advise your third party to start using your XI EORI if they submit your Entry Summary Declarations (ENS) in the TSS Portal.

- Tell your supplier your XI EORI if they arrange movements for you, so they can let the appropriate party know.

Eligibility criteria to apply for an XI EORI

You can apply for an XI EORI if your business isn’t based (‘established’) in Northern Ireland, if you need an XI EORI number to make certain declarations or act as a carrier, for example. You’ll need an indirect representative who is based in Northern Ireland to act on your behalf if you’re not established in Northern Ireland.

If your business is not based in the country you’re moving goods to or from, you should still get an EORI number if you are:

- Making a customs declaration for transit

- Making a customs declaration for temporary admission

- Applying for a customs decision

- Making an Entry Summary Declaration

- Making an exit summary declaration

- Making a temporary storage declaration

- Getting a customs guarantee for temporary admission or re-export declarations

- Acting as a carrier for transporting goods by sea, inland waterway or air

- Acting as a carrier connected to the customs system and you want to get notifications regarding the lodging or amendment of entry summary declarations

- Established in a common transit country where the declaration is lodged instead of an entry summary declaration or is used as a pre-departure declaration

You can apply at Apply for an EORI number on GOV.UK.

Which EORI number to use if you’re registered for the UK Internal Market Scheme (UKIMS)

The EORI number you enter in the Importer EORI field on your Entry Summary Declarations must match that of the UKIMS authorisation you intend to declare on your Supplementary or Full Frontier Declaration.

If you intend to use your UKIMS authorisation, you will need to provide the EORI number under which your UKIMS authorisation was registered to the person who submits the Entry Summary Declaration on your behalf. You can find the EORI number on recent correspondence from HMRC.

Which EORI number to use if you haven’t applied for your UKIMS authorisation

You should Apply for UKIMS Authorisation as soon as possible, using your XI EORI if you have one. To use your UKIMS authorisation on the TSS Portal, make sure your TSS Company Profile is updated with your UKIMS authorisation letter.

Which EORI number to use if you’re declaring goods ‘not at risk’

To continue submitting declarations using the NIREM code to declare your goods ‘not at risk’, you will need to Apply for UKIMS Authorisation for the UK Internal Market Scheme using your XI EORI.

Which EORI number to use if you use your Duty Deferment Account (DDA) for movements into Northern Ireland

HMRC wrote to advise that if you’re moving goods into Northern Ireland and Great Britain, you’ll need to have a separate DDA for both types of movements.

If you currently use your GB DDA to move goods into both NI and GB, for movements into NI you’ll need to apply for a new XI DDA using your XI EORI and backed by Customs Comprehensive Guarantee (CCG). You should do this as soon as possible as it could take several weeks.

For more information, visit How to set up an account to defer duty payments when you import goods. You can then keep your GB DDA for GB movements and use it to close any current or outstanding Supplementary Declarations in TSS where your GB EORI is used in the Importer EORI field.

Information to help you resolve error codes: Error code CDS40011

If you encounter the CDS error code ‘CDS40011’ whilst submitting your declaration, it is because a data value associated with a commodity code measure is missing. For example, a supplementary unit may have been left blank in a relevant field.

The error message should point you to the field to be reviewed. The requirements for that field will vary based on the requirements of your movement. Please review the Data guide: TSS declaration data requirements for more information relating to the specific fields.

There is guidance that provides information on common error codes and how to resolve them on NICTA. Be sure to bookmark these guides for quick reference in future should you need them:

- Error code guidance for Entry Summary Declarations and Simplified Frontier Declarations

- Error code guidance for Supplementary Declarations and Full Frontier Declarations

The Data Guide on NICTA provides further information on the TSS declaration data requirements.

When does the Supplementary Declaration need to be completed?

Submission of the Supplementary Declaration is required by the 10th calendar day of the month following the goods movement.

Why does it have to be submitted by the 10th calendar day?

When goods move using the TSS Simplified Procedure, where you delay the declaration and submit the information post movement on a Supplementary Declaration, you are using the TSS Simplified Declaration procedure authorisation. The rules of using the TSS Simplified Procedure state that you agree to:

- Provide us with all Supplementary Declaration information, or where converted post movement, Internal Market Movement Information (IMMI), reasonably required by us and as notified to you using your Account contact details; and

- Make payment in advance for any duty that may become payable because of the provision of these services and in any event by the 10th calendar day of the month, following the month in which the goods subject to movement are transferred

Additional Trader Support Service terms and conditions can be found in the TSS Terms.

Guidance on completing the Supplementary Declaration can be found in the Supplementary Declaration: Step-by-step guide on NICTA.

If you want to use the Internal Market Movement Information (IMMI) instead of a Supplementary Declaration, for your ‘not at risk’ goods that have moved into Northern Ireland (NI) using the TSS Simplified Procedure, the TSS Supplementary Declaration Conversion to Internal Market Movements Information (IMMI) Guide outlines how to convert an eligible ‘Draft’ or ‘Trader Input Required’ Supplementary Declaration into an Internal Market Movement Information (IMMI) in the TSS Portal.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact Trader Support Services (TSS)

Tel: 0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find Support Resources on NICTA to assist with your customs movements and using the TSS Portal.