Contents

- March Windsor Framework webinar: register now

- Check eligibility to move goods using the simplified processes

- UKIMS (UK Internal Market Scheme): what you need to know

- TSS Checklists for Hauliers and Traders

- Advanced warning of TSS Portal outage

- Trader Goods Profile (TGP) recap

- Ongoing TSS support

- DEFRA updates

- Helpful Windsor Framework guidance available on NICTA

- Windsor Framework Q&A

- TSS feedback survey

March Windsor Framework webinar: register now

Following the success of previous webinars, TSS will be hosting a webinar on the Windsor Framework using the TSS at 3pm GMT on Wednesday 19 March.

The purpose of this webinar is to provide information that supports the businesses or persons responsible for submitting the Entry Summary Declarations (ENS), in preparation for the Windsor Framework.

If you are a Haulier or a business involved in the supply chain and movement of goods from Great Britain to Northern Ireland, you may benefit from attending this webinar where information around using the simplified processes for Internal Market Movements will be shared.

This will include the following topics:

- A recap of Windsor Framework simplified processes

- Trader Support Service Journey Options

- Access and Permissions for Journeys

- Q&A

Event speakers include:

- Shanker Singham | TSS Customs and Trade Policy Lead

- Doreen Crawford | TSS Stakeholder Manager

- David Valley | HMRC Northern Ireland Stakeholder Engagement Lead

There are limited spaces available, so please make sure you register for the webinar. Questions can be submitted in advance as part of registration and are invaluable in shaping our future engagements. Once registered, we will issue instructions on how to join the webinar closer to the time of the event.

Please be aware that this session will be recorded and uploaded to the Northern Ireland Customs & Trade Academy (NICTA), where you can find further learning resources, including the recording of the 14 February 2024 webinar along with further learning resources.

Check eligibility to move goods using the simplified processes

Traders and hauliers involved in moving goods between GB and NI should take proactive steps to ensure compliance and maintain seamless operations by benefitting from the implementation of the simplified processes for Internal Market Movements.

This aims to reduce unnecessary paperwork, checks and duties for goods deemed ‘not at risk’ of leaving the UK. It is recommended traders and hauliers follow these key steps.

Check the category of your goods

Traders wanting to use the simplified processes for Internal Market Movements when transporting goods from GB to NI will need to determine their eligibility to move goods using the Internal Market Movement Information (IMMI).

Categorisation is a process based on legal regulations and the specific composition and origin of goods, and is not to be confused with Classification, which is identifying the relevant commodity code for the goods.

Goods will be categorised as either Category 1, Category 2, or Standard goods, as follows:

- Category 1 goods are not eligible for the simplified processes, and you can continue to move your goods to NI the same way you do now. On the TSS Portal you can submit a Full Frontier Declaration or make use of the TSS Simplified Procedure, by submitting a Supplementary Declaration post movement.

- Category 2 and Standard goods are eligible for the simplified processes.

The category of your goods will determine how you can complete your IMMI, and usually less information is required for Standard goods.

How can I categorise my goods?

The following services are available to help categorise your goods:

- Traders can use the Northern Ireland Online Tariff Tool (OTT) to check eligibility. A series of questions will guide you through the categorisation of specific commodities.

- Traders can use their Trader Goods Profile (TGP) to check eligibility. A TGP will be automatically created when traders register for the UK Internal Market Scheme (UKIMS). TGP can be used to maintain a list of commonly transported goods and their categorisation, which can be used by traders or intermediaries to populate data in the IMMI.

- Traders can use the Trader Support Service (TSS) to check eligibility. When you submit an IMMI on the TSS Portal, you will be able to get support to check the goods category. The TSS Portal will provide information about the goods category and support traders to complete the relevant procedure code.

- Software developers can use the Northern Ireland Online Tariff Tool API: HMRC have published the technical specifications.

Register for the UK Internal Market Scheme (UKIMS)

To benefit from the simplified processes, businesses must obtain UKIMS authorisation. This means that goods moving from GB into NI will not be subject to the same processes that apply to other goods entering NI.

You will only need to submit Internal Market Movement Information based on commercial information, removing the requirement for a full declaration.

Update your key contacts

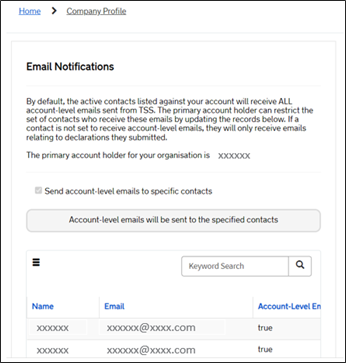

It is worth checking you have all the required contacts in your TSS Company Profile, that their details are correct and they are set to receive all account-level emails where needed.

Contacts who are not set to receive all account-level emails will only receive those relating to declarations they submitted.

Set Up Your Trader Goods Profile (TGP)

The TGP is an online service provided by HMRC that simplifies GB to NI movements by offering a customised profile populated with relevant trade information, including commodity codes of historically moved goods.

Establishing your TGP is crucial for efficient submission of IMMI. There is further guidance in Bulletin 186.

UKIMS (UK Internal Market Scheme): what you need to know

The UK Internal Market Scheme (UKIMS) is a trusted trader scheme for declaring goods moving from GB to NI. It replaced the UK Trader Scheme (UKTS) in June 2023.

Benefits of UKIMS

Simplified processes: Businesses can use simplified processes to declare goods from GB to NI that are ‘not at risk’ of entering the EU. Goods that are intended to remain in Northern Ireland or be consumed there are generally considered ‘not at risk’.

‘Not at risk’ goods will be charged:

- No duty if entering Northern Ireland from free circulation in Great Britain

- UK duty if entering Northern Ireland from outside of both the EU and the UK

- UK duty if entering Northern Ireland from Great Britain and the good was not in free circulation in Great Britain

If you are declaring goods ‘not at risk’ you will need to keep evidence within your records. The types of evidence to support a ‘not at risk’ goods movement include:

- Commercial receipts and invoices

- VAT invoices

- Commercial contracts and purchase orders

- Delivery receipts

- Consignment notes

- Proof of installation

- Electronic records

UKIMS eligibility requirements

- Who can apply? Businesses established in the UK, including those with a fixed place of business in Northern Ireland.

- Compliance: Applicants must have a good customs and tax compliance record, no serious criminal offences related to economic activity, and good financial standing.

- Records and controls: Businesses must have appropriate systems and controls to track goods and ensure they meet ‘not at risk’ criteria.

Is UKIMS mandatory?

UKIMS is not mandatory. However, implementing UKIMS allows traders to benefit from a simplified dataset declaration.

Guidance and common UKIMS questions can be found in Apply to the UK Internal Market Scheme (UKIMS) on NICTA.

How long does it take to complete a UKIMS application?

Provided you have all the necessary information, including your EORI number (which can be either a GB or XI EORI number), the application process takes about an hourIf you need help with your UKIMS application, please contact Trader Support Service for guidance. Further information and free training courses are also available on NICTA.

What type of organisations can apply for UKIMS?

- UK Registered Companies

- Sole Trader

- Partnership

- Charity

- Public body

- Government Department

- Plus others

TSS Checklists for Hauliers and Traders

To help Traders and Hauliers, TSS has added the following guides to the directory on NICTA:

These guides include information on steps to take to prepare for the simplified processes and your options on the TSS Portal to benefit from the processes.

Advanced warning of TSS Portal outage

On Sunday 23 March 2025 the TSS Portal will be updated. This update will require a short downtime, which is currently planned from 17:00 to 22:00. Further information on the update will be available in the next bulletin.

Trader Goods Profile (TGP) recap

What is the Trader Goods Profile and how do I use it?

The Trader Goods Profile (TGP) supports the new arrangements being introduced for moving goods from GB to NI as part of the Windsor Framework. You should be fully prepared by 31 March 2025 for these new arrangements.

TGP is an online service which is available to UK Internal Market Scheme (UKIMS) authorised traders that can be used to store information about goods you commonly move from GB to NI.

Every UKIMS authorised trader has their own TGP. If you choose to use it, once it’s set up you’ll be able to save time when the new arrangements come into effect. This is because your TGP can be used to complete certain Internal Market Movement Information (IMMI) data fields.

Each record in your TGP will contain a goods description, commodity code, product reference, country of origin, category of goods and supplementary units if required. Information on the data fields is published in the Internal Market Movement Checklist for Traders and the Internal Market Movement Checklist for Hauliers.

You will only have to add movement-specific information such as volume, mass and value to the IMMI. The information in your TGP can be used to auto-populate the IMMI providing you have set it up and have given TSS the access permission.

The IMMI is a simplified data set which can be used instead of a full declaration for ‘not at risk’ goods you move from GB to NI as part of the simplified processes for Internal Market Movements.

For more information on TGP, including what information it will store, see Bulletin 183 from 5 December 2024.

Further information on submitting the IMMI and using your TGP on the TSS Portal can be found on NICTA.

How do I sign up to use my Trader Goods Profile?

We advised you in Bulletin 184 that to sign up to access and use your TGP your business will need to be subscribed to the Customs Declaration Service, also referred to as CDS.

If your business is not already subscribed to the CDS, you will need to subscribe before you can gain access to your Trader Goods Profile. You can subscribe to the Customs Declaration Service via GOV.UK.

How do I access the TGP on the TSS Portal?

As the TGP, hosted by HMRC, is now available to UKIMS authorisation holders, you will be able to access your TGP through the TSS Portal as well as via GOV.UK.

Provided you have completed the access and permissions on your TSS Company Profile, you will be able to access your TGP on the TSS Portal, and, when available, use it to populate data into your Internal Market Movements when you submit an IMMI.

Additionally, in the TSS Portal you can grant access to a third party (e.g. a haulier, intermediary, agent) to manage your TGP on your behalf.

The following TSS guidance has been published on NICTA:

- How to access your Trader Goods Profile and set up your access permissions

- The Trader Goods Profile and how to use it on the TSS Portal

Can I use my Trader Goods Profile and submit the IMMI if I’m using a parcel carrier to move goods GB to NI?

If you use a parcel carrier they may complete the Internal Market Movement Information (IMMI) on your behalf as part of their service. This is completed outside of the TSS.

You will only need to provide your parcel carrier with a goods description in plain English and relevant commercial information.

You will not be able to use the Trader Goods Profile (TGP) for goods moved by most carriers. If you are moving business-to-business parcels from GB to NI then speak to your parcel carrier about their arrangements.

Ongoing TSS support

Some TSS users have asked for confirmation of ongoing TSS support through 2025 and into 2026. HMRC have previously confirmed this in their September 2024 announcement of the procurement exercise for the next phase of the Trader Support Service.

DEFRA updates

Northern Ireland Retail Movement Scheme (NIRMS) guidance

The Department for Environment, Food & Rural Affairs (DEFRA) has released updated labelling guidance on GOV.UK for the Northern Ireland Retail Movement Scheme (NIRMS).

Northern Ireland Plant Health Label (NIPHL) scheme guidance

To make the information easier to access, the guidance for the Northern Ireland Plant Health Label (NIPHL) scheme has now been split into separate parts. All of this guidance is available on the Northern Ireland plant health label (NIPHL) scheme home page on GOV.UK.

New SPS controls for non-qualifying Northern Ireland goods

This is a reminder that on 25 February 2025 sanitary and phytosanitary controls began for non-qualifying Northern Ireland goods that enter GB from NI.

Traders moving non-qualifying Northern Ireland goods via this route are now required to pre-notify the arrival of their goods on the import of products, animals, food and feed system (IPAFFS) and provide the relevant sanitary certificates (EHCs) or phytosanitary certificates (PCs).

Qualifying Northern Ireland goods continue to benefit from unfettered market access and are not subject to these controls. There is guidance on Moving non-qualifying Northern Ireland goods from Northern Ireland to Great Britain on GOV.UK.

Helpful Windsor Framework guidance available on NICTA

On NICTA there are guides to help with your readiness for when the Windsor Framework simplified processes are in full effect. Clicking on the Moving Goods from Great Britain to Northern Ireland option on the menu bar at the top of any page will direct you to further information concerning Internal Market Movement.

Here are some useful links:

- Internal Market Movement Checklist for Traders

- Internal Market Movement Checklist for Hauliers

- Simplified processes for Internal Market Movements – Introduction Guide

- TSS Permissions Management for TGP and UKIMS

- Trader Goods Profile (TGP) Guide

- Internal Market Movement Information (IMMI) Data Guide

- Internal Market Movement Information (IMMI) Procedures and Additional Procedure Codes Guide

- NEW Video: Preparing for the Windsor Framework using the TSS Portal

- NEW Video: Preparing for the Windsor Framework using the Trader Goods Profile

- NEW Video: Using TSS to submit your Internal Market Movement information

Windsor Framework Q&A

Is it mandatory for all businesses to register with UKIMS?

No – UKIMS is not a mandatory scheme but can be beneficial to traders who move goods from GB into NI that remain within the UK Internal market. See Apply for authorisation for the UK Internal Market Scheme if you bring goods into Northern Ireland on GOV.UK.

Could I be asked for evidence to show my goods remained in NI under my UKIMS authorisation?

Yes – part of HMRC granting the authorisation was that you agreed to maintain and provide records and show a clear understanding of your obligations under the authorisation and how to comply with them.

When you are moving goods as ‘not at risk’ under this scheme, you need to keep supporting evidence for each consignment you move into Northern Ireland and this evidence will need to be accessible to HMRC in the UK for 5 years.

Additional information can be found at Apply for authorisation for the UK Internal Market Scheme if you bring goods into Northern Ireland on GOV.UK.

How and where do we configure our UKIMS permissions on TSS?

You will be able to define and configure your UKIMS permissions through your TSS Company Profile. Full step-by-step instructions on this can be found on NICTA:

- TSS Permissions Management for TGP and UKIMS

- Video: Preparing for the Windsor Framework using the TSS Portal

Is there anywhere we can get assistance with joining UKIMS?

Yes – if you reach out to the Trader Support Service, they can provide guidance and support on completing the UKIMS application.

I have registered for UKIMS but lost the confirmation letter, how would I get a replacement?

Contact the HMRC UKIMS team by email ([email protected]) and they may be able to forward you a copy.

We are unable to register for UKIMS. Is there anything we need to do to prepare for Windsor Framework?

No – you can continue moving goods using the current process.

Our company is UKIMS registered and we are using TSS. Will this be affected and do we have to use TGP?

Ensure you have updated the UKIMS access permission if third-party TSS users are completing information on your behalf, as you need to grant permissions to use your UKIMS. The Trader Goods Profile is not mandatory, it is an optional tool provided by HMRC.

TSS feedback survey

TSS is always looking for ways to improve and we would be very grateful if you could complete a short survey about how you use the TSS and what we can do to improve.

Your comments and opinions are very important to us and will be very helpful in shaping the way the TSS continues to grow and support service users.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.