Contents

- Key update: ICS2 implementation for Entry Summary Declarations

- Consignment First / Associate Consignment functionality for ICS2 movement types

- NICTA guides updates

- Are you using the correct commodity codes for your goods?

- TSS tip: Are your TSS Company Profile settings correct?

- New document codes for claiming European Union preference under EU-UK TCA

- ICS2: Request for Information and Request for Amendment

Key update: ICS2 implementation for Entry Summary Declarations

What is changing for Entry Summary Declarations?

As we have published in recent TSS bulletins, webinars and podcasts, the system to which the TSS Portal submits safety and security declarations, known as Entry Summary Declarations (ENS), is changing.

The Import Control System Northern Ireland (ICS-NI) is being replaced by Import Control System 2 (ICS2) and businesses were asked by HMRC to prepare for this move to ICS2 by 1 September 2025.

HMRC recognised readiness issues with the wider implementation across ICS2 territories with preparing to migrate to ICS2 by 1 September 2025 and wrote to UK businesses on 8 August 2025 allowing them extra time to prepare, if required.

The Trader Support Service (TSS) made the required changes to the Entry Summary Declaration data form, to be ready for the initial ICS2 implementation date of 1 September.

TSS Portal users can use the updated Entry Summary Declaration options that submit to ICS2 when completing an Entry Summary Declaration or a Consignment. These are shown in the portal as ‘RoRo Accompanied [ICS2]’ or ‘RoRo Unaccompanied [ICS2]’. TSS recommends that you continue preparations and migrate to the new Entry Summary Declaration forms as planned.

What does this mean to me as a TSS user?

If you have already started using the ‘RoRo Accompanied [ICS2]’ or ‘RoRo Unaccompanied [ICS2]’ options to submit your Entry Summary Declarations via the TSS Portal or API you should continue to do so, or if you expect to be ready to use this option by 1 September 2025, you should continue preparations and transition as planned.

What if I am not yet ready?

If you need more time to prepare, you should work with your supply chain to be fully prepared for this system change. HMRC will confirm the latest date to migrate to ICS2 as soon as possible, but it will be no later than the end of December 2025.

The ‘RoRo Accompanied/Unaccompanied’ option for submitting Entry Summary Declarations to ICS-NI will remain available to all TSS users until HMRC confirm the new implementation date for movements into Northern Ireland.

Please note that due to updates on the TSS Portal having gone live from 17 August in readiness for the ICS2 initial implementation date of 1 September 2025, the Entry Summary Declaration – Consignment and Start a Consignment for a Goods Movement option on the TSS Portal now displays the ICS2 form only. However, if the consignment is associated to an ICS-NI header, then the information will still be submitted to ICS-NI and not to ICS2.

Where can I find more information on ICS2?

Follow the NICTA guidance below on how to complete Entry Summary Declarations in TSS with the new ICS2 requirements:

- ENS Step-by-step guide: Standard Process and Consignment First Process

- ENS step-by-step guide for maritime movements from GB to NI

- TSS Pre-lodged Standalone Internal Market Movement Information (IMMI) Guide

TSS has hosted two webinars on ICS2:

- Introducing Changes to the Entry Summary Declaration due to ICS2

- Preparing for ENS changes in the TSS portal due to ICS2

These can be found on the Webinars and Recordings page on NICTA, alongside previous TSS webinars and podcasts.

Consignment First / Associate Consignment functionality for ICS2 movement types

The consignment first functionality within TSS allows consignments to be created independently and later linked to the movement information on the Entry Summary Declaration (ENS) header.

Following the TSS update on 17 August, this functionality can now be created for ICS2 movement types only, and the Associate Consignment(s) button will be visible when entering an ICS2 movement type into an (ENS) header record and the type of movement is:

- Maritime

- RoRo Unaccompanied [ICS2] or

- RoRo Accompanied [ICS2]

This allows traders (or their representative) to associate a consignment they created using the Start a Consignment for a Goods Movement option with an ENS movement header using an ICS2 movement type (RoRo Accompanied [ICS2], RoRo Unaccompanied [ICS2], or Maritime). On the ENS movement header, the TSS user can do this by selecting the Associate Consignment(s) button.

If you are a trader completing the consignment, you will need to provide your haulier with the Local Reference Number (LRN) so the correct consignment can be selected by the ENS submitter.

If the haulier is using the RoRo Accompanied [ICS2] or RoRo Unaccompanied [ICS2] movement type in the ENS movement header, then the consignment must be created using one of these movement types for all the ICS2 required information to be complete.

If your haulier is using ‘RoRo Accompanied / Unaccompanied’ (i.e., ICS-NI) movement type in the ENS header, then an ICS2 or an ICS-NI created consignment can be associated with the movement header.

For further help and support with the TSS Portal functionality, the TSS Contact Centre is available 07:30 – 22:30, 7 days a week. Tel: 0800 060 8888 and Welsh speakers Tel: 0800 060 8988.

NICTA guides updates

Following the TSS Portal update on 17 August 2025, there have been some updates on the NICTA website to the following guides:

- Checklist: Entry Summary Declarations – for freight forwarders

- Checklist: Entry Summary Declarations – for hauliers and carriers

- Checklist: Entry Summary Declarations for traders of controlled goods

- Checklist: Entry Summary Declarations for traders of excise goods

- Checklist: Entry Summary Declarations for traders of SPS goods

- Checklist: Entry Summary Declarations for traders of standard goods

- Internal Market Movement Checklist for Hauliers

- Data guide: TSS declaration data requirements

- ENS step-by-step guide for maritime movements from GB to NI

- ENS Step-by-step guide: Standard Process and Consignment First Process

- How to use the TSS Portal

- Pre-movement Internal Market Movement Information (IMMI) Step-by-Step guide

- Using Transit for moving goods from GB to NI via Ireland

All guides and more resources are available on NICTA.

Are you using the correct commodity codes for your goods?

What are commodity codes?

Commodity codes are reference numbers used to classify goods according to their nature, use and unique characteristics. They are also known as HS (Harmonised System) codes or Tariff codes.

Commodity codes help customs authorities worldwide to:

- Identify the type of goods being moved between customs territories

- Apply the relevant customs duties and tariff measures

Traders, freight forwarders and customs agents need to use commodity codes to:

- Fill in commercial paperwork and customs declarations

- Check and calculate any duty or import VAT payable

- Identify if there are any trade agreements, restrictions or other measures that apply to the goods

How to classify your goods

The Harmonised System (HS) nomenclature structure classifies goods into 6-digit commodity codes according to rules. It is overseen by the World Customs Organization (WCO), which is the intergovernmental organisation for rules and security in international trade. All commodity codes are uniform up to the first 6 digits.

The length of a commodity code will vary according to the type of movement it is being used:

- For exports, an 8-digit commodity code is usually required.

- For imports to NI, the length of the commodity code will be dependent on the type of declaration being made:

- Where the Internal Market Movement Information (IMMI) is being submitted (for UK Internal Market Scheme (UKIMS) authorised traders only from GB-NI), a minimum of 6 or 8 digits is require, depending on the category of the goods. See Check the category of your goods on GOV.UK.

- Where a full customs declaration is being submitted, a 10-digit commodity code is usually required.

Note: An Entry Summary Declaration, sometimes referred to as a safety and security declaration, must be completed for all movements to NI and requires a 6-digit commodity code.

In the UK, there are two online platforms to help you to classify goods and view applicable tariff measures.

- For goods moving to/from England, Scotland and Wales you need to use the UK Integrated Online Tariff

- For goods moving to/from NI you need to use the Northern Ireland Online Tariff

You can search by entering the name of the goods or the commodity code in the Search page under Search for a commodity.

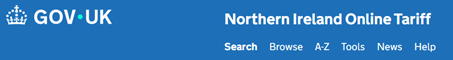

Alternatively, you can determine a commodity code by selecting Browse from the main menu bar and then:

- Identifying the relevant tariff section and chapters that apply

- Specifying the chapter

- Determining the appropriate tariff heading

- Selecting the subheading and commodity code

For example, shampoos fall under Section VI Products of the chemical or allied industries.

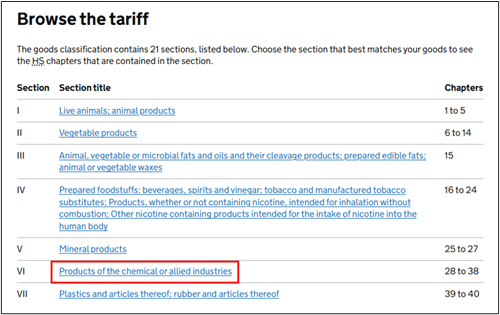

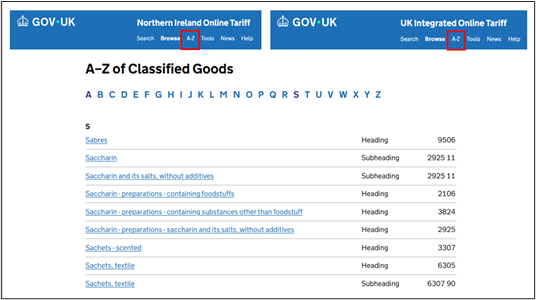

It is also possible to find the commodity code for your goods by using the A-Z function from the main tariff menu:

Click on the letter relating to the name of the goods and proceed to the entry required:

Additional support to classify your goods

If you have tried to find the appropriate tariff code for your goods but have not been successful, you may wish to email HMRC’s Tariff Classification Service for advice.

If you require a legally binding ruling, for goods you are importing to or exporting from NI, you can Apply for a Binding Tariff Information decision on GOV.UK.

You can find further guidance to classify your goods on the How to identify your commodity codes guide on NICTA.

TSS tip: Are your TSS Company Profile settings correct?

Avoid incorrect information on your declaration: check your TSS Company Profile settings

We urge all businesses with a TSS account to check that the information entered on their TSS Company Profile is correct. This includes all traders, hauliers, and carriers.

Why is this important?

The information from your TSS Company Profile can be used to populate information on your movements, so if the information is not correct on your profile, it may lead to incorrect information being declared on your movement.

We would like to highlight one section in particular: Do you want the company name to be private? If you select ‘Yes’, this means that your name and address is kept private and cannot be auto-populated into required fields on the movements by TSS.

Your EORI, company name and address are needed for movements on TSS. Selecting ‘Yes’ to this question means that for each movement your company name and address needs to be manually entered, as TSS cannot help populate the fields for the submitter.

- It is time consuming for the submitter to repeatedly enter this information.

- It can often lead to significant errors on the declaration as incorrect information is submitted.

How can you make this easier?

We urge you to check your privacy settings and ensure they are set to ‘No’ to optimise efficiency.

Where asked Do you want the company name to be private? selecting ‘No’ will allow TSS to automatically populate this information from your TSS company profile using your EORI number.

New document codes for claiming European Union preference under EU-UK TCA

There have been changes under Appendix 5A regarding the correct use of preference codes when claiming European Union (EU) preference on goods movements to Northern Ireland (NI) using the EU -UK Trade and Cooperation Agreement (TCA).

The guidance was updated on 5 Aug 2025 to replace the current preference document codes with U116, U117 and U118.

This table details what you must include for each Goods Record:

| Previous document Code | New document code | When | |

| Document Reference box | U110 | U116 | If the claim is based on a ‘statement on origin’ for a single shipment. |

| U111 | U118 | If the claim is based on a ‘statement on origin’ for multiple shipments of identical products, to cover a 12-month period. | |

| U112 | U117 | If the claim is based on importers knowledge. | |

| The Preference field must include a preference code in the 300 series. | |||

| The Country of Preferential Origin field must be completed with the country that the goods originate from | |||

CDS will continue to accept EU preference claims temporarily using document codes U110, U111 and U112 to allow time to switch over to U116, U117 and U118. Notice will be provided for switching but you, your agents and intermediaries should start using the correct document codes.

For further information, refer to Customs declaration completion requirements for Great Britain on GOV.UK.

ICS2: Request for Information and Request for Amendment

When traders use ICS2 to move goods, a small proportion of consignments will trigger a behind-the-scenes response from ICS2, such as a request for information or a request for amendment.

If ICS2 requires a trader response to proceed with goods movement, a message is sent to the TSS service team with the trader’s details and the specific ICS2 request. A TSS service agent will then contact the trader to discuss and resolve the query as quickly as possible.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.