Contents

- New Certificates Exchange System (CERTEX) for licensed goods now live

- Updates to the TSS Portal and NICTA: what to expect

- Confirmation of the new ICS2 mandatory adoption date

- ICS2: request for information and request for amendment

- What is the Northern Ireland Retail Movement Scheme (NIRMS)?

- When does the Supplementary Declaration need to be completed?

- A message from HMRC regarding TSS procurement

New Certificates Exchange System (CERTEX) for licensed goods now live

Licence data on Northern Ireland declarations is now verified by a new Certificates Exchange System (CERTEX), which replaced the previous Automatic Licence Verification System (ALVS) for Northern Ireland on 15 September 2025. Electronic documents raised on systems such as TRACES NT will now be verified by CERTEX.

CERTEX verifications apply to the following certificates:

| Certificate type | Certificate type detail | Document Code |

|---|---|---|

| CHED-A | Live Animals | C640 |

| CHED-P | Products of Animal Origin | N853 |

| CHED-D | Food and Feed of Non-Animal Origin | C678 |

| CHED-PP | Plant and Plant Products | C085 |

| Certificate of Inspection (COI) | Certificate of Organic Conformity | C644 |

| F-GAS – Import Only | Fluorinated Gases | Y986, Y123, Y124, Y120, Y951, C057, C079, C082 |

| O-Zone Depleting Substances (ODS) | O-Zone Depleting Substance | L100 |

What are the changes?

Common Health Entry Document (CHED) reference format

The format of the CHED reference number on Northern Ireland declarations has changed in line with CERTEX requirements and must be provided in the following format: letters followed by numbers including the full stop character. This would look like CHEDA.XX.20YY.nnnnnnn, where XX is the country of issuance, YY is the year, and nnnnnnn is the number (7 digits) with (optional suffix ‘V’). Examples of this would be ‘CHEDA.XI.2024.1234567’ or ‘CHEDA.XI.2024.1234567V’.

You must ensure that your pre-lodged declarations have the correct format and document codes. If not, you will need to amend and resubmit.

Please check Appendix 5A on GOV.UK, which has been updated to reflect changes of the CHED format as well as declaration completion instructions for all other Document References associated with Northern Ireland declarations.

Additional Document Code required for plant and plant products (CHED.PP licences)

Under CERTEX, Document Code C085, which refers to the Common Health Entry Document for Plants and Plant Products (CHED-PP), become mandatory and must also be declared when either Document Code N002 (Conformity Certificate) or N851 (Phytosanitary Certificate) is declared.

What does this mean for TSS users?

Traders moving goods to Northern Ireland must make sure the information provided on their declaration matches the information on the relevant licence or certification, such as licence reference number, commodity code, net mass, and supplementary units (where applicable).

Traders moving plant and plant products (CHED-PP) need to add additional Document Code C085 to their declaration, in addition to N002 (Conformity Certificate) or N851 (Phytosanitary Certificate).

This applies for all licence types mentioned above on your Simplified Frontier Declaration, Full Frontier Declaration, Internal Market Movement Information and Supplementary Declaration.

Any queries raised by CERTEX are received in TSS as a Customs Declaration Service (CDS) declaration response, with the pre-fix ‘CERTEX’ followed by query explanatory text.

The status of the declaration in TSS, which is subject to a CERTEX query, will change to ‘Amendment Required’ at consignment level and ‘Trader Input Required’ at header level. TSS will inform you via email that an amendment is required due to a CERTEX query. You will then need to make the necessary amendments in response to the CERTEX query and resubmit your declaration.

If the information on your declaration does not match your licence, then your goods may be subject to a hold or may need to be reported for inspection upon arrival in Northern Ireland.

The Goods Vehicle Movement Service (GVMS) messaging service will notify the haulier which Department of Agriculture, Environment and Rural Affairs (DAERA) or Border Force facility to report to when required.

If you need help with the declaration amendments related to a CERTEX query, please contact the Trader Support Service.

For more guidance on CERTEX including how to complete specific information on your declarations, see Moving licensed goods into or out of Northern Ireland on GOV.UK

Updates to the TSS Portal and NICTA: what to expect

Upcoming TSS Portal updates, currently scheduled for implementation on 5 October 2025 will enhance the handling of Entry Summary Declarations to Import Control System (ICS2) and related transport information, improving compliance for movements from Great Britain to Northern Ireland. ICSNI will remain optional for use until the end of the 2025.

Ability to change the Identity Number of Transport

If you are submitting Entry Summary Declarations to ICS2, you will be able to amend information provided in the Identity Number of Transport field.

When RoRo Accompanied [ICS2] or RoRo Unaccompanied [ICS2] movement type is selected on your ENS you will be able to amend the vehicle registration number or the trailer registration number up to 4 hours before the scheduled arrival.

Note: it will not be necessary to amend the vessel information originally provided in the ENS submission due to any last minute changes caused by breakdown or weather conditions, as HMRC can still access the correct information through GVMS.

Commodity code flexibility for non-controlled goods

If you are moving non-controlled goods and submitting Entry Summary Declarations to ICS2, you can now declare either a 6-digit commodity code or a 10-digit commodity code.

If you provide a 10-digit commodity code, the first 6 digits will be sent to ICS2.

New field: Type of Passive Transport

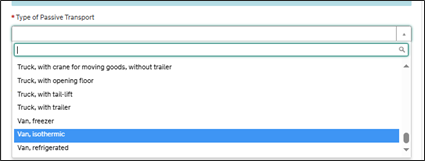

A new Type of Passive Transport data field will be required when ‘RoRo Accompanied [ICS2]’ is selected within the Type of Movement on the ENS. This will appear underneath the Type of Movement field.

The Type of Passive Transport field will have a list of options to select from, and you must use the option that best describes the type of transport on which the goods move.

Examples include truck with tail-lift, truck with trailer, and van- refrigerated.

What is the Type of Passive Transport?

In combined transportation (for example a truck transported on a ferry), the truck that is loaded onto a ferry/ship is referred to as the ‘passive means of transport’ in regulations related to safety and security requirements. The Type of Passive Transport field in TSS captures this information on Entry Summary Declarations.

Updates will be made to the following guides on NICTA to reflect all of the latest changes:

- Data guide: TSS declaration data requirements

- ENS step-by-step guide for maritime movements from GB to NI

- ENS Step-by-step guide: Standard Process and Consignment First Process

- Pre-movement Internal Market Movement Information (IMMI): Step-by-Step guide

- TSS Supplementary Declaration Conversion to Internal Market Movement Information (IMMI)

Further guides and resources are available in the Guide Directory on NICTA.

Confirmation of the new ICS2 mandatory adoption date

HMRC recently confirmed that those traders who need more time to prepare to move to ICS2 will be able to submit Entry Summary Declarations(ENS) via the Import Control System Northern Ireland (ICS-NI) for movements until 31 December 2025. Traders should continue to work with their supply chain now to make sure they’re ready for ICS2 as soon as possible and no later than 31 December 2025.

As a Trader Support Service (TSS) user, you can continue to submit Entry Summary Declarations using ICS-NI or the new ICS2 dataset if ready to do so. For movements from 1 January 2026 the new ICS2 dataset will become mandatory for all TSS users. You don’t need to register to use ICS2, as we will do this for you.

ICS2: request for information and request for amendment

When traders use Import Control System 2 (ICS2) to move goods, a small number of consignments will trigger a behind-the-scenes response from ICS2, such as a request for information or a request for amendment.

If ICS2 requires a trader response to proceed with the goods movement, the system will automatically send a message to the TSS service team with the trader’s details and the specific ICS2 request. A TSS service agent will then contact the trader to discuss and resolve the query as quickly as possible.

What is the Northern Ireland Retail Movement Scheme (NIRMS)?

The Windsor Framework sets out dedicated arrangements to support the critical flow of agrifood retail products into Northern Ireland. The Northern Ireland Retail Movement Scheme (NIRMS) establishes a way to move agrifood retail products for final consumers such as food, drink, pet food and food contact materials from Great Britain to Northern Ireland.

How can you use NIRMS for goods movements from Great Britain to Northern Ireland?

NIRMS simplifies customs procedures by allowing businesses use electronic documentation. Businesses registered to move goods under the scheme can move goods on a single General Certificate for eligible consignments supported by a packing list.

There will be no need for an official veterinary or plant health inspector to approve the documentation. Instead, goods will move based on a trader declaration under the authority of the UK competent authority.

What goods can move under NIRMS?

NIRMS is for retail food goods that will be sold in Northern Ireland to the final consumer.

Goods falling into the following categories will be automatically eligible to move:

- All Great Britain origin products

- All Northern Ireland products processed in Great Britain

- All EU origin products

There is information on which retail food goods can be moved under the scheme on GOV.UK.

Who can register to use NIRMS?

All businesses in England, Scotland, Wales and Northern Ireland responsible for moving or selling food for final consumption in Northern Ireland can register for the Northern Ireland Retail Movement Scheme (NIRMS). This includes:

- Retailers selling finished goods to end consumers

- Hospitality venues in Northern Ireland, such as pubs and restaurants, who are bringing goods in directly from Great Britain

- Businesses providing food to the public sector (schools, hospitals, prisons, etc.)

- Wholesalers supplying retail outlets

- Businesses operating factory canteens

Can you move NIRMS goods on groupage and mixed load consignments?

Yes. HMRC have issued guidance on how to move groups of agrifood products from Great Britain (England, Scotland and Wales) to Northern Ireland, which may include consignments of Northern Ireland Retail Movement Scheme (NIRMS) goods and consignments of non-NIRMS goods.

Further guidance is available on NICTA

When does the Supplementary Declaration need to be completed?

Submission of the Supplementary Declaration is required by the 10th calendar day of the month following the goods movement.

Why does it have to be submitted by the 10th calendar day?

When goods move using the TSS Simplified Procedure, where you delay the declaration and submit the information post movement on a Supplementary Declaration, you are using the TSS Simplified Declaration Procedure authorisation. The rules of using the TSS Simplified Procedure state that you agree to:

- Provide us with all Supplementary Declaration information, or where converted post movement the Internal Market Movement Information (IMMI), reasonably required by us and as notified to you using your Account contact details; and

- Make payment in advance for any duty that may become payable because of the provision of these services and in any event by the 10th calendar day of the month, following the month in which the goods subject to movement are transferred

Additional Trader Support Service terms and conditions can be found in the TSS Terms.

Guidance on completing the Supplementary Declaration can be found in the Supplementary Declaration: Step-by-step guide on NICTA.

If you want to use the Internal Market Movement Information (IMMI) instead of a Supplementary Declaration, for your ‘not at risk’ goods that have moved into Northern Ireland (NI) using the TSS Simplified Procedure, the TSS Supplementary Declaration Conversion to Internal Market Movements Information (IMMI) Guide outlines how to convert an eligible ‘Draft’ or ‘Trader Input Required’ Supplementary Declaration into an Internal Market Movement Information (IMMI) in the TSS Portal.

A message from HMRC regarding TSS procurement

The message below was shared with us by HMRC for all users of the TSS Portal:

The UK Government remains committed to making it as easy as possible to move goods between Great Britain and Northern Ireland.

In February 2025, HM Revenue and Customs (HMRC) launched a competitive procurement exercise for the next phase of the Trader Support Service, inviting bids to deliver continued support from 2026.

This exercise is ongoing, and HMRC expects to announce the successful provider in December 2025. HMRC will provide regular updates and work with their partners to ensure there is no disruption to your use of the service as we move into 2026.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Tel: 0800 060 8888

Welsh speakers Tel: 0800 060 8988