Contents

- Message from HMRC regarding a delay to CERTEX implementation

- Register now for the July Webinar: Preparing for ENS changes in the TSS Portal due to ICS2

- Advanced warning of TSS Portal outage

- Phase 3 Labelling requirements under the Northern Ireland Retail Movement Scheme (NIRMS) now in effect

- TSS tip: Are you following the correct process in GVMS for your goods movements?

- The Windsor Framework 2 months on

Message from HMRC regarding a delay to CERTEX implementation

On 3 June, HMRC announced CERTEX, a system that will verify licence data on declarations for goods movements. It will replace the Automatic Licence Verification System (ALVS) for Northern Ireland.

CERTEX will no longer be implemented from 28 June 2025. A new implementation date has not been set.

What to do next

You may need to take action depending on whether you are moving goods from Great Britain to Northern Ireland or from the Rest of the World to Northern Ireland.

You should continue to follow standard processes for controlled goods in Northern Ireland, including reporting for inspections where required to do so.

Moving goods from Great Britain to Northern Ireland

This delay does not affect the use of the new Common Health Entry Document (CHED) reference format on your declarations from 28 June 2025. The reference format is letters followed by numbers and includes the full stop characters. For example, ‘CHEDA.XI.2025.1234567’.

Declarations using the existing format (e.g. ‘GBCHD2025.1234567’) will not be rejected, however we encourage traders to use the new format in readiness for the implementation of CERTEX at a later date.

You will not receive CERTEX specific messages for these movements on the TSS Portal, so you must continue to monitor the Goods Vehicle Movement Service (GVMS) at GVMS locations or the respective inventory system at inventory locations.

For detailed guidance, please visit Moving licensed goods into or out of Northern Ireland on GOV.UK.

Moving goods from Rest of World to Northern Ireland

This delay means you must not use the new Common Health Entry Document (CHED) format on your declarations from 28 June 2025. You must continue to use the existing format found in Appendix 5A on GOV.UK, for example, ‘GBCHD2025.1234567’.

If you have pre-lodged any declarations using the new format these must be changed, before arrival, on the Customs Declaration Service (CDS). Failure to use the correct CHED format will result in rejections or holds on your goods once the goods arrive and potentially delays in getting the goods released.

Please continue to monitor messages in the TSS Portal for any ‘ALVS’ messages.

Next steps

HMRC has apologised for any inconvenience caused by the delay to the implementation of CERTEX and advised they will provide further information in due course.

Processes for making a declaration or obtaining a licence remain unchanged.

Additional support

For support for goods in movement, contact the Department of Agriculture and Rural Affairs (DAERA) on 0300 200 7852 or email [email protected].

For general support with freight movements or if a change is required on your declaration, traders can contact the Trader Support Service team. For other queries call the HMRC Customs and International Trade helpline on 0300 322 9434 (textphone 0300 200 3719).

For support with parcels movements, traders can contact their parcel express operator. Please note this change does not impact express operators moving consumer parcels under the UK Carrier Scheme.

Register now for the July Webinar: Preparing for ENS changes in the TSS Portal due to ICS2

Following the success of previous webinars, TSS will be hosting a second webinar ‘Preparing for ENS changes in the TSS Portal due to ICS2’, which will take place at 1:30pm BST on Tuesday 8 July.

The phased introduction of the Import Control System 2 (ICS2) by movement type began last year in the TSS Portal. Changes for Maritime have already been implemented. The purpose of this webinar is to provide context for the final phase, specifically for Roll-on Roll-off (RoRo) movements, and to share information that will help you prepare for the relevant TSS Portal updates.

If you are a Haulier or Trader moving goods from Great Britain to Northern Ireland and want to understand how to create an Entry Summary Declaration (ENS) following changes due to ICS2, you may find this webinar useful.

We will cover the following topics:

- A recap on Safety and Security Declarations from HMRC

- An overview of Trader and Haulier roles

- How to create an ENS for RoRo in the TSS Portal

- An overview of changes for API users

- Next steps Q&A

Event speakers include:

- Shanker Singham | TSS Customs and Trade Policy Lead

- Doreen Crawford | TSS Stakeholder Manager

- Hena Elsayed | TSS Trade and Customs Specialist

- Piers Micklem | HMRC Customs Policy Advisor

- Lisa Khan | HMRC External Readiness Manager ICS2

There are limited spaces available, so please make sure you register for the webinar. Questions can be submitted in advance as part of registration and are invaluable in shaping our future engagements. Once registered, you will receive instructions on how to join the webinar closer to the time of the event.

Please be aware that this session will be recorded and uploaded to the Northern Ireland Customs & Trade Academy (NICTA), where you can find further learning resources, including the recordings of previous TSS webinars and further learning resources.

Advanced warning of TSS Portal outage

On July 13, there will be an update to the TSS Portal, which will require a short downtime. This outage is currently planned for Sunday 13 July 2025 from 17:00 to 22:00. Further information on the update will be available in the next bulletin.

Phase 3 Labelling requirements under the Northern Ireland Retail Movement Scheme (NIRMS) now in effect

The Department for Environment, Food & Rural Affairs (DEFRA) has confirmed that the third phase of labelling requirements under the Northern Ireland Retail Movement Scheme (NIRMS) came into effect from 1 July 2025.

This means individual ‘Not for EU’ product-level labelling is now required for a broader range of food products moved under NIRMS from Great Britain (GB) to Northern Ireland (NI) retail premises.

Individual product labelling is mandatory for all products that fall within scope of Phase 3 labelling. The label must be clearly visible on the individual product packaging to indicate that the goods are not intended for sale or onward movement into the European Union (EU). This requirement applies regardless of the product’s origin.

Products Requiring Individual Labelling in Phase 3

In addition to the meat and dairy products already in scope from phases 1 and 2, the categories below now also need to have a ‘Not for EU’ label on each individual item:

- All pre-packed and sealed fruit and vegetables

- All fresh, frozen and processed fish

- Eggs

- Honey

- Food supplements produced from animal products, with no added plant products

- All chilled or frozen composite products and some chilled plant products that require certification or controls at a border control post (BCP)

- All shelf-stable composite products, unless they are listed in the Exemptions section of the guidance on GOV.UK

- High-risk food of non-animal origin (HRFNAO), where it is controlled under Regulation 2019/1793

- Cut flowers where they are listed in Part A of Annex XI and Annex XII to the phytosanitary conditions Regulation (EU) 2019/2072

A 30-day transition period is in place, meaning that Phase 3 products moved to NI before 1 July 2025 will not need individual product labels until 31 July 2025.

In addition, NI retailers must display appropriate signage in store, indicating that goods moved under NIRMS are intended only for consumption in the UK and must not be sold in the EU.

TSS tip: Are you following the correct process in GVMS for your goods movements?

This article summarises the information required for all goods movement options available on the TSS Portal from Great Britain to Northern Ireland, that use the Goods Vehicle Movement Service (GVMS). Detailed guidance on the Goods Movement Reference (GMR) and step by step instructions on how to complete a GMR in GVMS can be found in the Creating a Goods Movement Reference guide on NICTA.

Standard goods using the TSS Simplified Procedure

Standard goods that move with the Entry in Declarants Records (EIDR) process submitted pre-movement and a Supplementary Declaration submitted post movement. This can be completed in the TSS Portal and the TSS reference begins with ‘DEC’. What information do you need for GVMS? The Entry Summary Declaration Movement Reference Number (MRN) and the Trader EORI, Local Reference Number (LRN) and Procedure Code are required on the GMR to meet Notice of Presentation (NOP) requirements.

Controlled goods using the TSS Simplified Procedure

Controlled goods that move with the Simplified Frontier Declaration submitted pre-movement and a Supplementary Declaration submitted post movement. This can be completed in the TSS Portal and the TSS reference begins with ‘SFD’. What information do you need for GVMS? The Entry Summary Declaration MRN and the Simplified Frontier Declaration MRN.

Internal Market Movements

Goods that move with the Internal Market Movement Information (IMMI) submitted pre-movement and no declaration needed post movement. This can be completed in the TSS Portal and the TSS reference begins with ‘GLR’. What information do you need for GVMS? The Entry Summary Declaration MRN and the Internal Market Movement Information (IMMI) MRN.

Full Frontier Movements

Goods that move with the Full Frontier Declaration submitted pre-movement and no declaration needed post movement. This can be completed in the TSS Portal and the TSS reference begins with ‘FFD’. What information do you need for GVMS? The Entry Summary Declaration MRN and the Full Frontier Declaration MRN.

What is an MRN and how do I get the MRN info for GVMS?

The Movement Reference Number (MRN) is usually 18 characters long, beginning with the two numbers of the year it was generated, for example, 25 for 2025, followed by the two-letter country code, either GB for Great Britain or XI for Northern Ireland.

How do I get the MRN information for GVMS?

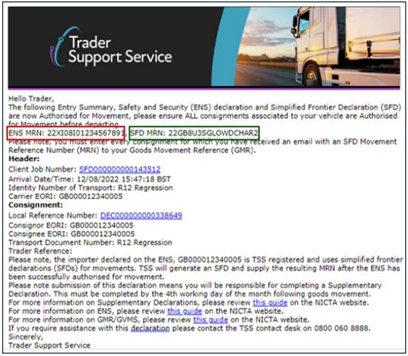

When you use the TSS Portal to submit this information, you will receive an email with the MRN and information you require for GVMS, if you are submitting this information manually. Here is an example email:

TSS offers a service where TSS can send the information to GVMS on your behalf, reducing the effort and potential errors when adding in the MRN information to GVMS for your movements. This is called GMR Automation, and you can set it up in your TSS Company Profile. Information on how to do this is detailed in the Creating a Goods Movement Reference guide on NICTA.

The Windsor Framework 2 months on

It’s been just over two months since the Windsor Framework simplified processes for Internal Market Movements were introduced.

Many businesses are using the simplifications available since 1 May 2025, when moving their eligible goods from Great Britain (GB) to Northern Ireland (NI), and some are just starting to look into how they can use them. Internal Market Movements offer additional, therefore optional, journeys you can choose to use in the TSS Portal when moving your goods to NI.

Here is a summary of what is available on the TSS Portal

Businesses can use the simplified processes for Internal Market Movements when they are moving eligible ‘not at risk’ goods to NI. Eligible goods are goods ‘not at risk’ of onward movement to the European Union (EU), that meet the criteria of the UK Internal Market Scheme (UKIMS) and that will stay in the UK Internal Market for final sale or consumption.

Simplified Dataset known as the Internal Market Movement Information (IMMI)

Under the Windsor Framework a new way was introduced to declare eligible goods moving from GB to NI using Internal Market Movement Information (IMMI). This simplified dataset can be submitted before the goods move, known as pre-lodged or pre-movement, or after the goods have arrived in NI, known as post-movement.

The IMMI is available for UKIMS authorised traders and can be submitted instead of using the Other NI Movements, where you are usually required to complete a post-movement Supplementary Declaration or a Full Frontier Declaration pre-movement.

Guidance on how to complete the IMMI pre-movement or post-movement is available on NICTA.

Many journey options are available for submitting your IMMI, using the TSS Portal or via an API, and the decision on which option to use needs to be agreed with your supply chain, to best support your business needs and requirements.

Goods movement information can be submitted directly onto the TSS Portal, or via API. Both options are fully supported by TSS. Details on API can be found on NICTA in the API: Functional Guide on NICTA.

Post-movement IMMI

Some businesses have chosen to continue moving their goods using the TSS Simplified Procedure, the same way they have moved goods prior to 1 May 2025, and the Importer of Record is opting to convert their related post-movement Supplementary Declaration in the TSS Portal to a post movement IMMI.

Using this approach there is no change in the way you move your goods, but you should let the carrier moving the goods on your behalf, and who is submitting the Entry Summary Declaration, know the correct EORI to use for the movement. This should be the EORI that your UKIMS authorisation is approved under and should match your TSS Company Profile (this will be an XI or GB EORI).

Once you are comfortable submitting the post-movement IMMI, you might want to try submitting a pre-movement IMMI, which means that all the information is provided before the goods move, and you do not need to submit any information, for example the Supplementary Declaration, post-movement.

Pre-movement IMMI

As the importer of record on the IMMI, and the person responsible for the movement, you can submit the IMMI pre-movement and provide the necessary movement information to the carrier so they can associate it with the Entry Summary Declaration (ENS) – this is needed to move the goods. This means that you do not need to submit or provide any information once the goods arrive in NI.

The carrier can also submit the IMMI on your behalf. You must ensure that as the importer and the person responsible for the movement, you agree this with your supply chain as you will need to provide the carrier with the correct information so they can populate the IMMI on your behalf before the goods move. You will also need to make sure you have given the carrier permission through your TSS Company Profile to submit the IMMI on your behalf– without the permission they can’t do this for you. See the TSS Permissions Management for TGP and UKIMS guide on NICTA for more information.

Trader Goods Profile (TGP) is available to populate goods information onto the Internal Market Movement Information (IMMI)

The Trader Goods Profile (TGP) is available for all UKIMS authorised traders and can be used to store your information about ‘not at risk’ goods you commonly move from GB to NI. This can then be used to populate the same information onto the IMMI when the goods move.

Storing the information in your TGP and using that stored information to populate the fields in the IMMI reduces the requirement to enter that information each time the goods move or provide it to the carrier if they are submitting the IMMI on your behalf. Instead of providing the goods information such as country of origin and commodity code each time you move the goods, you can give them the product reference that matches and is also stored in your TGP record.

See the Trader Goods Profile (TGP) Guide on NICTA for further information.

The TGP can be used on the TSS Portal when you are submitting the IMMI pre- and post-movement. However, you need to ensure you have set up the appropriate permissions to get the data, guidance and support are available, if needed, to ensure you have set up your TSS Company Profile in order to benefit from the Windsor Framework simplified processes.

Looking for information on how to start using the simplified processes for Internal Market Movements on the TSS Portal?

There are many other resources available to help to you decide if the simplified processes are suitable for your goods movements. The NICTA website contains dedicated pages with information, step-by-step portal guides, videos, webinars and podcasts on the options available to you.

There is further information on how to get started in these checklists:

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.