Contents

- Windsor Framework update

- Forthcoming changes to Entry Summary Declarations on TSS

- April Windsor Framework podcast

- Windsor Framework TSS Portal readiness dashboard: are you ‘IMMI ready’?

- What is the Northern Ireland Retail Movement Scheme (NIRMS)

- What is the UK Internal Market Scheme (UKIMS)

- Using NIRMS and UKIMS together on a goods movement

- Use of Meursing codes when moving ‘not at risk’ goods under UKIMS

- Windsor Framework guidance available on NICTA

Windsor Framework update

Following the guidance issued in September 2024, there has been extensive preparatory work for the new arrangements for the movement of goods from Great Britain to Northern Ireland (GB to NI) by parcels or freight as set out in the Windsor Framework. As a result, and subject to the relevant procedures, the new arrangements are planned to take effect from 1 May 2025.

Forthcoming changes to Entry Summary Declarations on TSS

Over the course of this summer, TSS will be implementing changes to the Entry Summary Declaration submission process for Roll-on Roll-off (Ro-Ro) movements into Northern Ireland (NI) to align with the introduction of Import Control System 2 (ICS2).

ICS2 is being introduced in phases by type of movement and has already been introduced for air and sea/maritime movements into NI. It is now being introduced for movements by road, which includes Ro-Ro movements, both Unaccompanied and Accompanied. This means:

- Road carriers who bring goods into NI or the EU must start using ICS2 now unless they have applied to use the Road Deployment Window for ICS2. Deployment windows must be requested from the Member State where EORI is registered as they are not automatically applicable. Onboarding after 1 April must be requested from HMRC by emailing [email protected]. If traders have not already requested use of the deployment window, they must request this from HMRC as soon as possible.

- If you already engage the Trader Support Service for your declarations, they will onboard you into the relevant deployment window to align with their services.

- All traders must complete the move from Import Control System NI (ICS-NI) to ICS2 by 1 September 2025, as from 1 September 2025 onwards road carriers who bring goods into NI or the EU will no longer be able to use the existing ICS-NI system.

How ICS2 works

The ICS2 system manages:

- Lodging of pre-arrival entry summary declarations

- Notification of arrival of goods

- Presentation of goods

- Assessment of safety and security risk

What does this mean for TSS Users?

The introduction of ICS2 will mean that the Entry Summary Declaration submission process on the TSS Portal will be updated to meet the information requirements of the new system.

Key changes:

- You will need to identify on the Entry Summary Declaration whether the movement is unaccompanied or accompanied.

- The vessel International Maritime Organisation (IMO) number will be required along with the trailer identifier for unaccompanied movements.

- Names and addresses of the Carrier, Importer/Exporter, Consignor/Consignee are required, alongside their EORI number where you have this – TSS will help by filling in this information where possible.

- A 6-digit HS code and goods description are required for each of the goods you are moving.

TSS will continue to support the filing of Entry Summary Declaration submissions. The Arrival and Presentation of Goods processes required by ICS2 will be supported by a new HMRC service that will require you to enter all Entry Summary Declaration Movement Reference Numbers (MRNs) into GVMS to gain a Goods Movement Reference (GMR) number for the movement.

You can continue to use TSS to submit Entry Summary Declarations, so you won’t need to register for ICS2 separately unless you want to receive notifications from the system.

When will the changes appear on the TSS Portal for Entry Summary Declaration submission?

Entry Summary Declaration submissions must use the new ICS2 system for Ro-Ro movements from 1 September 2025 onwards. To support user transition to the new requirements, TSS plans to allow submissions via both ICS-NI or ICS2 systems from July 2025. This will enable users to transition to the updated process before the 1 September deadline. From 1 September onwards only ICS2 process will be available when submitting Entry Summary Declarations using the TSS Portal.

TSS API users will be able to start integrating with the new requirements in the TSS API test environment from mid-May for unaccompanied movements and early July for accompanied movements.

Where can I find more information?

Information will be updated in due course, but for now, you can find information on how to submit an Entry Summary Declaration on both GOV.UK and NICTA:

- UK guidance on Making an entry summary declaration

- Current Ro-Ro guidance on NICTA: Entry Summary Declaration: Step-by-Step guide

- Current Maritime guidance on NICTA: ENS step-by-step guide for maritime movements from GB to NI

Further TSS information will be published on NICTA as functionality becomes available over the coming weeks.

April Windsor Framework podcast

We are excited to announce that a new TSS podcast – ‘Windsor Framework Unpacked: simplifying your GB to NI Market Movements’ – will shortly be available on NICTA.

This new format has been created in response to your feedback, to address common questions, help traders and hauliers think about how these procedures impact them, and provide information that can be consumed on the go.

In this 30-minute episode, TSS & HMRC specialists explore UKIMS, supply chain, and what ‘at risk’ means, to help you prepare for moving goods under the Windsor Framework simplified processes.

You will hear from:

- Doreen Crawford | Trader Support Service, Stakeholder Manager

- Shanker Singham | Trader Support Service, Customs and Trade Policy Lead

- Simon Pettigrew | HMRC Head of Strategy and Stakeholder Engagement – NI Customs

If you have listened to the podcast and still have questions outstanding, you might want to join us for a live Q&A session between 09:15 and 10:00am GMT on Thursday 17 April.

You can register for the Q&A using this registration link. Questions can be submitted in advance as part of registration or during the session. Once registered, you will receive instructions on how to join the webinar closer to the time of the event.

You can find further learning resources on NICTA, including the recording of the 19 March 2025 webinar.

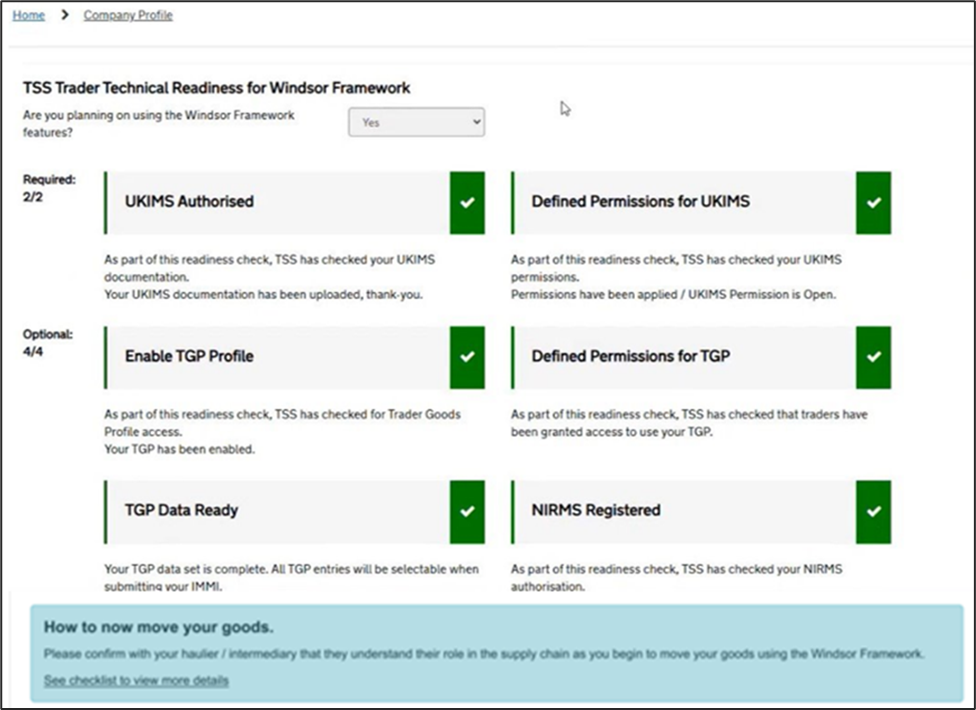

Windsor Framework TSS Portal readiness dashboard: are you ‘IMMI ready’?

On your TSS Company profile you are now able to view your own company dashboard to show if your TSS profile is ‘IMMI ready’.

What is ‘IMMI’ ready?

TSS has summarised all the Windsor Framework processes you can set up on your TSS Company profile to help you make use of the simplified processes for Internal Market Movements and submit the Internal Market Movement Information (IMMI).

To view your Windsor Framework readiness dashboard, the primary account holder should answer ‘Yes’ to the question ‘Are you planning on using the Windsor Framework features?’ at the top of your TSS Company Profile.

If you select ‘Yes’, the dashboard will then be visible for TSS to instantly review your profile and identify actions you can take to ensure you are ‘IMMI Ready’. As you complete each action, the dashboard will update to reflect the changes you make to your profile.

If you’re not planning to use the Windsor Framework simplified processes, you can select ‘No’ so that TSS knows your choice and movement preference.

Step 1 – upload your UKIMS authorisation

Why? Your UKIMS authorisation gives you access to submit an IMMI on the TSS Portal. It also gives you access to your Trader Goods Profile (TGP). Without your UKIMS authorisation added to your profile, you won’t be able to benefit from the Windsor Framework simplified processes on TSS or make ‘not at risk’ movements on the TSS Portal using your authorisation.

Step 2 – upload your NIRMS authorisation

Why? If you move goods via the Northern Ireland Retail Movement Scheme (NIRMS), uploading your scheme number to your TSS Company Profile allows TSS to support the correct categorisation of your goods on your TGP and on the IMMI. Giving TSS access to your NIRMS scheme number allows goods to be categorised and TSS to support auto-population of the required NIRMS information on the IMMI, as eligible goods can be moved as Standard Goods instead of Category 2 goods, but only if the information is on your TSS Company profile.

Step 3 – authorise TSS to access your TGP

Why? If you are using your TGP to populate data onto your IMMI, you’ll need to authorise TSS to access your TGP data from HMRC, since TGP is hosted by GOV.UK.

Step 4 – define your permissions for UKIMS and TGP

Why? If you engage with a haulier or intermediary to submit the IMMI on your behalf, you’ll need to set them up with the appropriate permissions to use your UKIMS authorisation and your TGP (if you are using one) to submit the IMMI data on the TSS Portal.

You can also give permission to a TSS third party account to manage and maintain your TGP data. However, as the UKIMS authorisation holder, you are responsible for the accuracy of the information submitted on the IMMI.

Detailed step-by-step guidance is available in the TSS Permissions Management for TGP and UKIMS guide on NICTA.

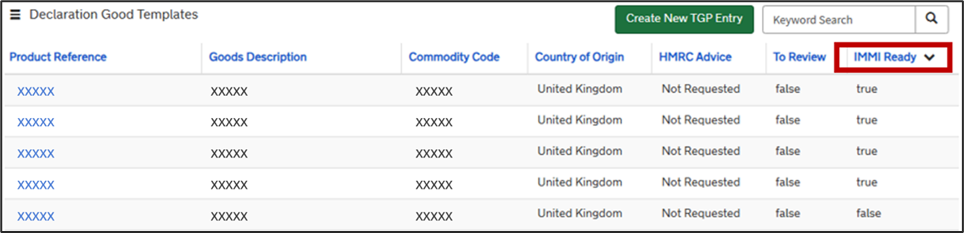

Step 5 – complete your TGP entries

Why? Your TGP entries must be complete in order to populate data onto your IMMI. Each entry requires a unique Product Reference, Goods Description, Commodity Code (6, 8 or 10 digits) and Country of Origin to be filled in and categorisation to have been finalised.

Step 6 – check that your TGP entries are ‘ready for IMMI’

Why? If you are using your TGP to populate data onto your IMMI, you’ll need to make sure that the goods entries you store are ‘ready for IMMI’ so that when the IMMI becomes available, you can use your TGP entries to help populate the information.

Detailed guidance on what the TGP is, how you can use it for your ‘not at risk’ goods movements and how you can manage your TGP through the TSS Portal is available in the Trader Goods Profile (TGP) Guide on NICTA.

What is the Northern Ireland Retail Movement Scheme (NIRMS)

The Windsor Framework sets out dedicated arrangements to support the critical flow of agrifood retail products into Northern Ireland. The Northern Ireland Retail Movement Scheme (NIRMS) establishes a way to move agrifood retail products for final consumers such as food drink, pet food and food contact materials from Great Britain to Northern Ireland.

How can you use NIRMS for goods movements from Great Britain to Northern Ireland?

NIRMS simplifies customs procedures by allowing businesses use electronic documentation. Businesses registered to move goods under the scheme can move goods on a single General Certificate for eligible consignments supported by a packing list.

There will be no need for an official veterinary or plant health inspector to approve the documentation. Instead, goods will move based on a trader declaration under the authority of the UK competent authority.

What goods can move under NIRMS?

The Northern Ireland Retail Movement Scheme (NIRMS) is for retail food goods that will be sold in Northern Ireland to the final consumer.

Goods falling into the following categories will be automatically eligible to move:

- All Great Britain origin products

- All Northern Ireland products processed in Great Britain

- All EU origin products

There is information on which retail food goods can be moved under the scheme on GOV.UK.

Who can register to use NIRMS?

All businesses in England, Scotland, Wales and Northern Ireland responsible for moving or selling food for final consumption in Northern Ireland can register for the Northern Ireland Retail Movement Scheme (NIRMS). This includes:

- Retailers selling finished goods to end consumers

- Hospitality venues in Northern Ireland, such as pubs and restaurants, who are bringing goods in directly from Great Britain

- Businesses providing food to the public sector (schools, hospitals, prisons, etc.)

- Wholesalers supplying retail outlets

- Businesses operating factory canteens

Can you move NIRMS goods on groupage and mixed load consignments?

Yes. HMRC have issued guidance on how to move groups of agrifood products from Great Britain (England, Scotland and Wales) to Northern Ireland, which may include consignments of Northern Ireland Retail Movement Scheme (NIRMS) goods and consignments of non-NIRMS goods.

Further guidance available on NICTA

What is the UK Internal Market Scheme (UKIMS)

The UK Internal Market Scheme (UKIMS) is an enhanced and expanded trusted trader scheme introduced under the Windsor Framework as a replacement to the UK Trader Scheme (UKTS). Authorised traders can use their UKIMS authorisation to move goods that will stay within the UK Internal Market into Northern Ireland (NI) and declare them ‘not at risk’. According to existing arrangements, the applicable EU rate of duty will not be payable on those goods.

How can you use UKIMS for goods movements to Northern Ireland?

Having a UKIMS authorisation allows you to declare eligible goods ‘not at risk’ using the Additional Information code ‘NIREM’ on the goods line item on the declaration. ‘Not at risk’ goods will be charged:

- No duty if entering Northern Ireland from free circulation in Great Britain

- UK duty if entering Northern Ireland from outside of both the EU and the UK

- UK duty if entering Northern Ireland from Great Britain and the good was not in free circulation in Great Britain

For goods movements from GB to NI, your UKIMS authorisation enables you to move your eligible ‘not at risk’ goods using the new simplified processes for Internal Market Movements and submit the simplified dataset known as the Internal Market Movement Information (IMMI) when they come into full effect.

To use your UKIMS authorisation on your goods movements on the TSS Portal you need to upload your authorisation letter to your TSS Company Profile.

What goods can move under UKIMS?

Unlike NIRMS, there is no goods list or specific commodities. However, not all goods are eligible to be moved using UKIMS.

The use of the UKIMS scheme is dependent on the status of the goods and if they meet the ‘not at risk’ eligibility to use the scheme.

To declare your goods ‘not at risk’ under the UKIMS, you need to know that the goods will remain in the UK Internal Market once they arrive in NI and that they are not ‘at risk’ of onward movement to the EU. It is the responsibility of the UKIMS authorisation holder to know this about their goods movements and keep supporting evidence for each of the good’s movements.

What does ‘not at risk’ and ‘at risk’ mean?

See Moving goods you bring into Northern Ireland as ‘not at risk’ of moving to the EU on GOV.UK.

Goods qualify as ‘not at risk’ of moving to the EU if you are bringing in goods for sale to, or for final use by end consumers located in NI (and GB) if certain conditions are met. This means that these goods will not be subject to EU tariffs and will instead be charged UK duty or no duty at all. Additionally, goods subject to processing must meet specific requirements to qualify and be declared ‘not at risk’

Goods are ‘at risk’ if they are likely to move into the EU. This means that these goods will be subject to EU tariffs rather than UK duty when declared in NI. These goods also considered ‘at risk’:

- Goods which are subject to commercial processing, where the additional requirements to declare them ‘not at risk’ are not met, cannot be declared ‘not at risk’. These goods are automatically ‘at risk’. You can find out more about the additional requirements for goods subject to processing on GOV.UK.

- Goods entering NI from countries outside of both the EU and UK, where the applicable EU rate of duty is more than the applicable UK duty by 3 percentage points or more, cannot be declared ‘not at risk’. These are automatically ‘at risk’.

- Goods subject to an EU trade remedy.

Who can register to use UKIMS?

All businesses in England, Scotland, Wales and Northern Ireland responsible for moving or selling goods brought into Northern Ireland for sale or final use by end consumers in the UK can apply for UK Internal Market Scheme (UKIMS) authorisation.

To apply you must be established in the UK and meet all the compliance, records, systems, controls, and evidence requirements.

You’ll need to meet additional processing requirements if you move goods into Northern Ireland to be processed and want to declare these goods ‘not at risk’.

Even where you’re not responsible for the end destination of the goods, you may still be able to be authorised and move goods as ‘not at risk’ if you can make sure that goods will meet the ‘not at risk’ criteria.

There is further guidance available on NICTA: Apply to the UK Internal Market Scheme (UKIMS).

Using NIRMS and UKIMS) together on a goods movement

Did you know that you can use NIRMS and UKIMS on the same goods movement to Northern Ireland?

As detailed in the articles above, NIRMS and UKIMS are different schemes: both have their specific benefits and you can use them together on the same goods movement to benefit from both schemes.

- The key benefit of NIRMS is simplified customs procedures and reduced paperwork requirements as eligible goods can move using a general certificate and packing list.

- The key benefit of UKIMS is simplified customs procedures and no customs duty payable on the eligible goods movement if the goods will remain in the UK Internal Market.

Applying both NIRMS and UKIMS to the goods moving to NI will result in less paperwork and no customs duty payable on those goods.

When the Windsor Framework is in full effect, goods moving from Great Britain to Northern Ireland using the simplified processes for Internal Market Movements can benefit from access to the simplified dataset IMMI, and using your NIRMS allows the goods to be categorised as standard goods instead of Category 2 goods.

Use of Meursing codes when moving ‘not at risk’ goods under UKIMS

If you are a UK Internal Market Scheme (UKIMS) authorised trader, using your authorisation to move ‘not at risk’ goods from Great Britain (GB) to Northern Ireland (NI), you can use the code 7000 for all commodities requiring a Meursing Code.

What are Meursing Codes?

Meursing codes are additional codes that describe the composition of goods containing certain types of milk and sugars and applies specific duties to these goods depending on the code.

The appropriate code should still be used for declaring ‘at risk’ movements from GB to NI as well as all Rest of World movements to NI, and can be identified via Look up Meursing code on GOV.UK.

Windsor Framework guidance available on NICTA

On NICTA there are guides to help with your readiness for when the Windsor Framework simplified processes are in full effect. Clicking on the Moving Goods from Great Britain to Northern Ireland option on the menu bar at the top of any page will direct you to further information concerning Internal Market Movement.

Here are some useful links:

- Internal Market Movement Checklist for Traders

- Internal Market Movement Checklist for Hauliers

- Simplified processes for Internal Market Movements – Introduction Guide

- TGP and UKIMS authorisation and permissions guide

- Trader Goods Profile (TGP) Guide

- TSS Arrived Standalone Internal Market Movement Information (IMMI) Guide (NEW)

- TSS Pre-lodged Standalone Internal Market Movement Information (IMMI) Guide (NEW)

- Internal Market Movement Information (IMMI) Data Guide

- Internal Market Movement Information (IMMI) Procedures Additional Procedure codes guide

- Video: Preparing for the Windsor Framework using the TSS Portal

- Video: Preparing for the Windsor Framework using the Trader Goods Profile

- Video: Using TSS to submit your Internal Market Movement Information

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.