Contents

- Windsor Framework update

- April Windsor Framework podcast and Q&A session a success

- Pre-lodged IMMI now available on the TSS Portal

- Windsor Framework TSS Portal feature: are you ‘IMMI ready’?

- Is your Trader Goods Profile (TGP) ready

- How to complete your GMR when you use the TSS Simplified Procedure journey for standard goods

- Windsor Framework: goods categorisation to check eligibility to move goods using the simplified processes

- Windsor Framework guidance available on NICTA

- Windsor Framework Q&A

Windsor Framework update

Following the guidance issued in September 2024, there has been extensive preparatory work for the new arrangements for the movement of goods from Great Britain to Northern Ireland (GB to NI) by parcels or freight as set out in the Windsor Framework. As a result, and subject to the relevant procedures, the new arrangements are planned to take effect from 1 May 2025.

April Windsor Framework podcast and Q&A session a success

On 10 April 2025, TSS published a podcast – Windsor Framework Unpacked: Answering Common questions – on NICTA.

This new format has been created in response to your feedback, to address common questions, help traders and hauliers think about how these procedures impact them, and provide information that can be consumed on the go.

In this 30-minute episode TSS and HMRC specialists explore UKIMS, supply chain and what ‘at risk’ means, to help you prepare for moving goods under the Windsor Framework simplified processes.

The podcast was followed by a live question and answer session on Thursday 17 April, where panelists answered questions from the audience during the 45-minute session. You can find some of the questions and answers in the Windsor Framework Q&A section of this bulletin.

Pre-lodged IMMI now available on the TSS Portal

From 24 April 2025, you can now pre-lodge the Internal Market Movement Information (IMMI) on the TSS Portal.

The functionality is now available for all eligible goods movements that are due to take place on or after 1 May 2025, to support the planned implementation of the new arrangements, as set out in the Windsor Framework.

There is guidance on NICTA on how to pre-lodge the IMMI on the TSS Portal:

- Video: Using TSS to submit your Internal Market Movement Information

- Pre-movement Internal Market Movement Information (IMMI) Step-by-Step guide

To pre-lodge the IMMI on the TSS Portal you will need to ensure your company profile is set up accordingly. If you are pre-lodging the IMMI on behalf of another TSS user, you must have appropriate access and permissions to do so.

You can read more about the TSS Portal readiness dashboard and how you can set up your TSS Company Profile in the next article ‘Windsor Framework TSS Portal feature: are you ‘IMMI ready’?’

Windsor Framework TSS Portal feature: are you ‘IMMI ready’?

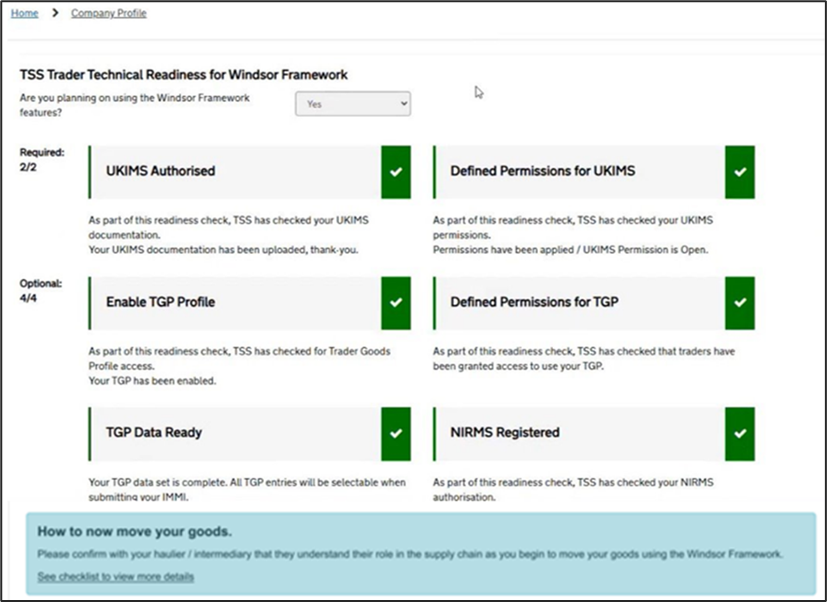

On your TSS Company profile you are now able to view your own company dashboard to show if your TSS profile is ‘IMMI ready’.

What is ‘IMMI’ ready?

TSS has summarised all the Windsor Framework processes you can set up on your TSS Company profile to help you make use of the simplified processes for Internal Market Movements and submit the Internal Market Movement Information (IMMI).

To view your Windsor Framework readiness dashboard, the primary account holder should answer ‘Yes’ to the question ‘Are you planning on using the Windsor Framework features?’ at the top of your TSS Company Profile.

If you select ‘Yes’, the dashboard will then be visible for TSS to instantly review your profile and identify actions you can take to ensure you are ‘IMMI Ready’. As you complete each action, the dashboard will update to reflect the changes you make to your profile.

If you’re not planning to use the Windsor Framework simplified processes, you can select ‘No’ so that TSS knows your choice and movement preference.

Step 1 – upload your UKIMS authorisation

Why? Your UKIMS authorisation gives you access to submit an IMMI on the TSS Portal. It also gives you access to your Trader Goods Profile (TGP). Without your UKIMS authorisation added to your profile, you won’t be able to benefit from the Windsor Framework simplified processes on TSS or make ‘not at risk’ movements on the TSS Portal using your authorisation.

Step 2 – upload your NIRMS authorisation

Why? If you move goods via the Northern Ireland Retail Movement Scheme (NIRMS), uploading your scheme number to your TSS Company Profile allows TSS to support the correct categorisation of your goods on your TGP and on the IMMI. Giving TSS access to your NIRMS scheme number allows goods to be categorised and TSS to support auto-population of the required NIRMS information on the IMMI, as eligible goods can be moved as Standard Goods instead of Category 2 goods, but only if the information is on your TSS Company profile.

Step 3 – authorise TSS to access your TGP

Why? If you are using your TGP to populate data onto your IMMI, you’ll need to authorise TSS to access your TGP data from HMRC, since TGP is hosted by GOV.UK.

Step 4 – define your permissions for UKIMS and TGP

Why? If you engage with a haulier or intermediary to submit the IMMI on your behalf, you’ll need to set them up with the appropriate permissions to use your UKIMS authorisation and your TGP (if you are using one) to submit the IMMI data on the TSS Portal.

You can also give permission to a TSS third party account to manage and maintain your TGP data. However, as the UKIMS authorisation holder, you are responsible for the accuracy of the information submitted on the IMMI.

Detailed step-by-step guidance is available in the TSS Permissions Management for TGP and UKIMS guide on NICTA.

Step 5 – complete your TGP entries

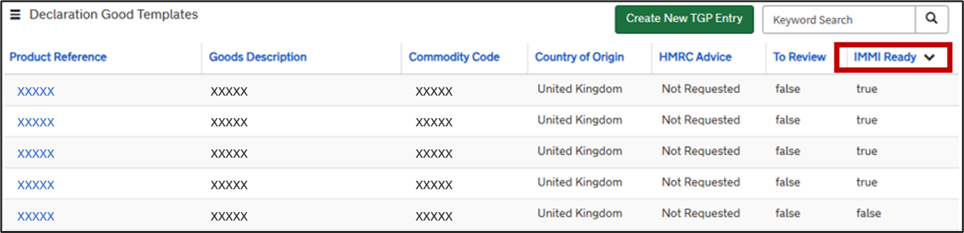

Why? Your TGP entries must be complete in order to populate data onto your IMMI. Each entry requires a unique Product Reference, Goods Description, Commodity Code (6, 8 or 10 digits) and Country of Origin to be filled in and categorisation to have been finalised.

Step 6 – check that your TGP entries are ‘ready for IMMI’

Why? If you are using your TGP to populate data onto your IMMI, you’ll need to make sure that the goods entries you store are ‘ready for IMMI’ so that when the IMMI becomes available, you can use your TGP entries to help populate the information.

Detailed guidance on what the TGP is, how you can use it for your ‘not at risk’ goods movements and how you can manage your TGP through the TSS Portal is available in the Trader Goods Profile (TGP) Guide on NICTA.

Is your Trader Goods Profile (TGP) ready

What is the Trader Goods Profile and how do I use it?

The Trader Goods Profile (TGP) supports the new arrangements being introduced for moving goods from GB to NI as part of the Windsor Framework. It is an online service, available to UK Internal Market Scheme (UKIMS) authorised traders, that can be used to store information about goods you commonly move from GB to NI.

Every UKIMS authorised trader has their own TGP. If you choose to use it, once it’s set up you’ll be able to save time when the new arrangements come into effect. This is because your TGP can be used to complete certain Internal Market Movement Information (IMMI) data fields. Each record in your TGP will contain a goods description, commodity code, product reference, country of origin, category of goods and supplementary units if required. Information on the data fields is published in the Internal Market Movement Checklist for Traders and the Internal Market Movement Checklist for Hauliers.

You will only have to add movement-specific information such as volume, mass and value to the IMMI. The information in your TGP can be used to auto-populate the IMMI providing you set it up and give TSS the access permission.

The IMMI is a simplified data set which can be used instead of a full declaration for ‘not at risk’ goods you move from Great Britain to Northern Ireland as part of the simplified processes for Internal Market Movements.

How do I sign up to access and use my Trader Goods Profile?

Your business will need to be subscribed to the Customs Declaration Service, also referred to as CDS. Subscribing your Government Gateway user ID to CDS allows you to do things such as:

- Submit import and export declarations using software

- Get your postponed import VAT statements or get your import VAT certificates so you can complete your VAT Return

- Pay Customs Duty and import VAT

You do not need to subscribe to the CDS again if you have already done so for either imports or exports.

What is the Customs Declaration Service (CDS)?

The Customs Declaration Service supports making import and export declarations when moving goods into and out of the UK.

When you submit declarations using the TSS Portal, TSS submits the information you provide to CDS on your behalf.

How do I subscribe to CDS?

You can subscribe via GOV.UK: Subscribe to the Customs Declaration Service.

You’ll need the Government Gateway user ID and password that you use for your business or organisation:

- If you do not have a user ID, you can create one when you start.

- You cannot use an agent Government Gateway user ID.

Your EORI number and Customs Declaration Service accounts will be linked to your Government Gateway user ID. You cannot apply for more than one EORI number using your Government Gateway user ID.

If you need others in your business to use your subscription (and the services it gives access to) you can add a team member when using your business tax account.

You’ll be able to control what each team member can access.

Your business will still need to be UKIMS authorised to have a Trader Goods Profile for simplified processes for Internal Market Movements.

Further information on submitting the IMMI and using your TGP on the TSS Portal can be found on NICTA.

For more information on TGP, including what information it will store, see:

- Bulletin 183 – published 5 December 2024

- Bulletin 186 – published 30 January 2025

How to complete your GMR when you use the TSS Simplified Procedure journey for standard goods

Get ready for changes to Goods Vehicle Movement Service (GVMS)

There will be changes to GVMS on how to submit your information for standard goods movements using the TSS Simplified Procedure. You’ll be required to submit information known as a Notification of Presentation (NOP) via GVMS for standard goods moved using Entry into Declarant’s Records (EIDR) to Northern Ireland.

If you plan to use a pre-movement IMMI or currently use a Simplified Frontier Declaration or a Full Frontier Declaration, then this doesn’t affect your movements as you already submit the necessary information pre-movement.

You must continue to add all Movement Reference Numbers (MRN) for each movement into GVMS to obtain your GMR, to ensure your declarations have arrived correctly and maintain compliant goods movements.

What are the changes?

When you receive an email from TSS with your MRN for applicable movements, TSS will provide you with the Local Reference Number (LRN) and the procedure code that you’ll need for GVMS. If you are moving standard non-controlled goods on the TSS Simplified Procedure journey, the Procedure Code is ‘4000’.

What TSS can do to support

Did you know that you can automate your GMR submission through the TSS Portal so you don’t have to submit the information to GVMS manually? This is called ‘GMR automation’. If you choose this option in your company profile, TSS will submit the information to GVMS on your behalf using the information you submitted to TSS for the Entry Summary Declaration.

The Entry Summary Declaration: Step-by-step guide on NICTA includes guidance on how to do this, in the ‘GMR automation (ENS Header)’ section.

Windsor Framework: goods categorisation to check eligibility to move goods using the simplified processes

Traders using the simplified processes for Internal Market Movements must check the category of their goods when transporting goods from Great Britain to Northern Ireland, to determine their eligibility to move goods using the Internal Market Movement Information (IMMI).

Categorisation is a process based on legal regulations, and the specific composition and origin of goods and is not to be confused with Classification, which is identifying the relevant commodity code for the goods.

Goods will be categorised as either Category 1, Category 2 or Standard goods, as follows:

- Category 1 goods are not eligible for the simplified processes

- Category 2 and Standard goods are eligible for the simplified processes

The category of your goods will inform how you can complete your IMMI, as less information is required for Standard goods.

How will the category of goods inform how you can complete your IMMI?

Standard goods can move under a 6-digit commodity code. This includes certain SPS controlled goods moving under a NIRMS authorisation.

Controlled (Category 2 goods) can move under an 8-digit commodity code.

How can I categorise my goods?

There are a number of services available to help you categorise your goods, as follows:

- Traders will be able to use the Northern Ireland Online Tariff Tool (OTT). Traders can check the category of specific commodities using the OTT`s open access tool. The OTT is a simple tool which helps traders navigate the different steps through a series of accessible questions.

- Traders can use their Trader Goods Profile (TGP). A TGP will be automatically created when traders register for the UK Internal Market Scheme (UKIMS). TGP can be used to maintain a list of business’ commonly transported goods and their categorisation, which can be used by traders or intermediaries to populate data in the IMMI.

- Traders can use the Trader Support Service (TSS). When you submit an IMMI on the TSS Portal, you will be able to get support to check the goods category. The TSS Portal will provide information about the goods category and support traders to complete the relevant procedure code.

- Northern Ireland Online Tariff Tool API for software developers: HMRC have published the technical specifications.

What should I do to prepare?

You can check the category of your goods now by using the Northern Ireland Online Tariff Tool (OTT) to check eligibility to move goods on the simplified processes.

You will need to know the goods you move from GB to NI, including the country of origin and the 10-digit commodity code.

What if my goods are Category 1?

If your goods are Category 1 and therefore not eligible to use the simplified processes, you can continue to move your goods to Northern Ireland the same way you do now.

Using the TSS Portal, you can submit a Full Frontier Declaration or make use of the TSS Simplified Procedure, by creating an Entry Summary Declaration before the goods move and submitting a Supplementary Declaration post movement

Windsor Framework guidance available on NICTA

On NICTA there are guides to help with your readiness for when the Windsor Framework simplified processes are in full effect. Clicking on the Moving Goods from Great Britain to Northern Ireland option on the menu bar at the top of any page will direct you to further information concerning Internal Market Movement.

Here are some useful links:

- Internal Market Movement Checklist for Traders

- Internal Market Movement Checklist for Hauliers

- Simplified processes for Internal Market Movements – Introduction Guide

- TGP and UKIMS authorisation and permissions guide

- Trader Goods Profile (TGP) Guide

- TSS Arrived Standalone Internal Market Movement Information (IMMI) Guide (NEW)

- TSS Pre-lodged Standalone Internal Market Movement Information (IMMI) Guide (NEW)

- Internal Market Movement Information (IMMI) Data Guide

- Internal Market Movement Information (IMMI) Procedures Additional Procedure codes guide

- Video: Preparing for the Windsor Framework using the TSS Portal

- Video: Preparing for the Windsor Framework using the Trader Goods Profile

- Video: Using TSS to submit your Internal Market Movement Information

Windsor Framework Q&A

Q – We sell to Company A in Northern Ireland, who then sells to Company B. How can we be sure that our goods are ‘not at risk’?

A – If you are the UKIMS authorisation holder and are not the end user of the goods in Northern Ireland then you need to ensure you obtain evidence that those goods are ‘not at risk’. Examples of evidence can be found here.

Q – Do we need a UKIMS authorisation if both our business and our customer have an NIRMS approval?

A – NIRMS and UKIMS are different schemes, and both may be beneficial to use depending on the goods and their categorisation. NIRMS can be used on its own to move agri-foods goods to NI and UKIMS can be used for ‘not at risk’ goods so no customs duty is payable, therefore UKIMS and NIRMS can be used at the same time for the same goods when moved to NI, to benefit from both schemes.

Q – We as a retailer are selling to both consumers (B2C) and businesses (B2B), but they are all our end customers and goods are for their sole purposes, not sold on and do not move out of NI. Do we still need to be UKIMS registered?

A – Yes, you can look to be UKIMS authorised if you want to benefit from the scheme. If you are the Importer of Record on those movements of ‘not at risk’ goods, then you will not need to pay customs duty on those goods and can benefit from the simplified processes when they come into effect. It is a business decision to use UKIMS or the simplified processes.

Q – As a UK wholesaler selling to Northern Ireland independent shops, is it me or the shop that requires the UKIMS authorisation?

A – It can be either business and this is a decision you will need to agree on before the goods move. If the GB Sender is the UKIMS authorisation holder and therefore the Importer of Record, then you may need to obtain evidence from the NI receivers that the goods are ‘not at risk’. Alternatively, the NI Receivers could be the UKIMS authorisation holders and the Importer of Record for the movement.

Q – Is there anything a business needs to do if they only move goods ‘at risk’ and are already UKIMS registered?

A – If your goods are ‘at risk’, then your goods would not be eligible to move using your UKIMS authorisation. Your UKIMS authorisation can be used for eligible ‘not at risk’ goods. If you move ‘at risk’ goods you can continue moving your goods as you do today. It is the authorisation holder’s responsibility to ensure UKIMS is only used for eligible ‘not at risk’ movements to NI.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.