Contents

- Windsor Framework now live

- How to complete your GMR when you use the TSS Simplified Procedure journey for standard goods

- Windsor Framework: Goods categorisation to check eligibility to move goods using the simplified processes

- Windsor Framework Trader Goods Profile (TGP) recap

- Windsor Framework guidance available on NICTA

- Volunteer to help HMRC improve the Trader Goods Profile

- Are you using the correct Goods Descriptions in the TSS Portal?

- The Northern Ireland Plant Health Label (NIPHL)

- TSS tip: Are your TSS Company Profile settings correct?

- Apply for a voluntary clearance amendment (underpayment) (C2001)

Windsor Framework now live

The new arrangements for the movement of goods from Great Britain (GB) to Northern Ireland (NI) by parcels or freight, as set out in the Windsor Framework, took effect on 1 May 2025.

For business-to-business (B2B) parcel movements, there are new processes that you will need to follow to ensure goods continue to move quickly and smoothly. For existing freight movements, new simplified processes have been introduced that traders may wish to take advantage of.

Detailed guidance on GOV.UK includes:

- Key information about these arrangements

- Additional Windsor Framework resources with information on actions you may need to take

How to complete your GMR when you use the TSS Simplified Procedure journey for standard goods

This article looks at changes to Goods Vehicle Movement Service (GVMS) on how to submit your information for standard goods movements using the TSS Simplified Procedure.

You are now required to submit information known as a Notification of Presentation (NOP) via GVMS for standard goods moved using Entry into Declarant’s Records (EIDR) to Northern Ireland.

If you plan to use a pre-movement IMMI or currently use a Simplified Frontier Declaration or a Full Frontier Declaration, then this doesn’t affect your movements as you already submit the necessary information pre-movement.

You must continue to add all Movement Reference Numbers (MRN) for each movement into GVMS to obtain your GMR, to ensure your declarations have arrived correctly and maintain compliant goods movements.

What are the changes?

When you receive an email from TSS with your MRN for applicable movements, TSS will provide you with the Local Reference Number (LRN) and the procedure code that you’ll need for GVMS. If you are moving standard non-controlled goods on the TSS Simplified Procedure journey, the Procedure Code is ‘4000’.

Support offered by TSS

Did you know that you can automate your GMR submission through the TSS Portal, so you don’t have to submit the information to GVMS manually? This is called ‘GMR automation’. If you choose this option in your company profile, TSS will submit the information to GVMS on your behalf using the information you submitted on the Entry Summary Declaration.

The Entry Summary Declaration: Step-by-step guide on NICTA includes guidance on how to do this, in the ‘GMR automation (ENS Header)’ section.

Windsor Framework: Goods categorisation to check eligibility to move goods using the simplified processes

Traders moving goods from GB to NI must check the category of their goods to ensure they are eligible to move using the simplified processes for Internal Market Movements and the Internal Market Movement Information (IMMI).

Categorisation is a process based on legal regulations, and the specific composition and origin of goods, and is not to be confused with Classification, which is identifying the relevant commodity code for the goods.

Goods will be categorised as either Category 1, Category 2 or Standard goods, as follows:

- Category 1 goods are not eligible for the simplified processes

- Category 2 and Standard goods are eligible for the simplified processes

The category of your goods will inform how you can complete your IMMI, as less information is required for Standard goods.

How will the category of goods inform how I can complete an IMMI?

Standard goods can move under a 6-digit commodity code. This includes certain SPS controlled goods moving under NIRMS authorisation (for more information on NIRMS authorisation, see Bulletin 191 on NICTA). Controlled (Category 2 goods) can move under an 8-digit commodity code.

| Category | Description | Length of Commodity Code |

| Standard goods | All goods (excluding excise) that have no documentary controls and/or have no licensing requirements. Prepackaged retail food and drink goods moving under NIRMS also fall into this category. | 6 digits |

| Category 2 goods | These goods are subject to special health, licensing or environmental controls including excise goods. Northern Ireland Plant Health Label (NIPHL) scheme movements also fall into this category. | 8 digits |

| Category 1 goods | These are goods that are subject to total bans, prohibitions, trade defence measures such as quotas, safeguarding and anti-dumping duties. Goods that are subject to the excise duty off-set mechanism are also considered in this category. The IMMI cannot be used for goods in this category. | 10 digits |

How can I categorise my goods?

There are a number of services available to help you categorise your goods:

- Traders will be able to use the Northern Ireland Online Tariff Tool (OTT) to check the category of specific commodities. The OTT is a simple tool which helps traders navigate the different steps through a series of accessible questions.

- Traders can use their Trader Goods Profile (TGP). This will be automatically created when traders register for the UK Internal Market Scheme (UKIMS). TGP can be used to maintain a list of business’ commonly transported goods and their categorisation, which can be used by traders or intermediaries to populate data in the IMMI.

- Traders can use the Trader Support Service (TSS). When you submit an IMMI on the TSS Portal, you will be able to get support to check the goods category. The TSS Portal will provide information about the goods category and support traders to complete the relevant procedure code.

- Northern Ireland Online Tariff Tool API for software developers: HMRC have published the technical specifications.

What if my goods are Category 1?

If your goods are Category 1 and therefore not eligible to use the simplified processes, you can continue to move your goods to Northern Ireland the same way you do now.

Using the TSS Portal, you can submit a Full Frontier Declaration or make use of the TSS Simplified Procedure, by creating an Entry Summary Declaration before the goods move and submitting a Supplementary Declaration post movement.

Windsor Framework Trader Goods Profile (TGP) recap

TGP supports the new arrangements introduced for moving goods from Great Britain (GB) to Northern Ireland (NI) as part of the Windsor Framework. It is an online service which is available to UK Internal Market Scheme (UKIMS) authorised traders, that can be used to store information about goods you commonly move from GB to NI.

Every UKIMS authorised trader has their own TGP. If you choose to use it, once it’s set up, you’ll be able to save time because your TGP can be used to complete certain Internal Market Movement Information (IMMI) data fields. Each record in your TGP will contain a goods description, commodity code, product reference, country of origin, category of goods and supplementary units if required.

You will only have to add movement-specific information such as volume, mass and value to the IMMI. The information in your TGP can be used to auto-populate the IMMI providing you set it up and authorise TSS to access your TGP data from HMRC as TGP is hosted by GOV.UK.

You will need to subscribe to the Customs Declaration Service (CDS) on GOV.UK before you can gain access to your Trader Goods Profile. More information on the CDS is available in Bulletin 184, which was published on 19 December 2024.

If you engage with a haulier or intermediary to submit the IMMI on your behalf, you will need to set them up with the appropriate permissions to use your UKIMS authorisation and your TGP (if you are using one) to submit the IMMI data on the TSS Portal. You can also give permission to a TSS third party account to manage and maintain your TGP data.

Although you can give permission to a third party TSS user to submit IMMI data or manage your TGP on your behalf, you as the UKIMS authorisation holder are responsible for the accuracy of the information submitted on the IMMI.

Detailed step-by-step guidance is available in the TSS Permissions Management for TGP and UKIMS guide on NICTA.

More guidance and information on TGP and IMMI can be found on NICTA and linked below.

Windsor Framework guidance available on NICTA

On NICTA there are guides to help with the Windsor Framework simplified processes. Clicking on the Moving Goods from Great Britain to Northern Ireland option on the menu bar at the top of any page will direct you to further information concerning Internal Market Movement.

Here are some useful links:

- Internal Market Movement Checklist for Traders

- Internal Market Movement Checklist for Hauliers

- Simplified processes for Internal Market Movements – Introduction guide

- TSS Permissions Management for TGP and UKIMS

- Trader Goods Profile (TGP) Guide

- Internal Market Movement Information (IMMI) Data Guide

- Internal Market Movement Information (IMMI) Procedures and Additional Procedure Codes Guide

- Video: Preparing for the Windsor Framework using the TSS Portal

- Video: Preparing for the Windsor Framework using the Trader Goods Profile

- Video: Using TSS to submit your Internal Market Movement information

Volunteer to help HMRC improve the Trader Goods Profile

As part of the development and launch of the Trader Goods Profile, HMRC are looking to speak with traders to gain essential feedback so that improvements can be made to the digital service. If you’re interested in taking part in this research, please enter your email address here and the HMRC researcher will be in touch to schedule a session with you.

- These sessions will be for UKIMS traders

- Sessions will be remote and take 45-60 minutes

Are you using the correct Goods Descriptions in the TSS Portal?

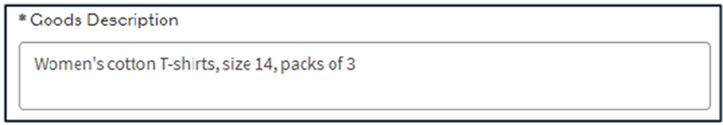

The Goods Description field is mandatory on TSS movements and must be completed in plain language and provide a detailed description of what is being shipped.

This ensures that checks for taxes and duties can be performed smoothly and that the goods will be stored, handled and transported safely.

Inadequate or generic descriptions such as ‘accessories’ or ‘samples’ may result in delays before or after movement. Shipments can be returned or seized if there are ambiguities.

Consider the following when entering a Goods Description:

- What are your goods?

- What are your goods made of?

- What is their purpose?

If your goods are packaged, this should be included in the Goods Description.

Include brand and model number for branded items, for example, ‘Garmin Forerunner 55 smartwatch, black casing, silicon strap’

For excise goods, you must include the volume, brand name and container size, for example, ‘Hand rolling tobacco, Amber Leaf, 500g’.

Descriptions for alcohol goods must include the strength, for example, ‘Gin, Gordon’s London Dry, 700ml, ABV 40%’.

Where goods are grouped under a single commodity code, the word ‘grouping’ should be added, for example, ‘Machine knitted woollen vests – grouping’.

For further guidance, please see the Goods Description Guide on NICTA.

The Northern Ireland Plant Health Label (NIPHL)

What is the Northern Ireland Plant Health Label Scheme?

Under the Windsor Framework agreement, the Northern Ireland Plant Health Label (NIPHL) scheme is a way for growers and traders in Great Britain (GB) to move plants and seeds for planting, used agricultural and forestry machinery, and seed potatoes to Northern Ireland (NI).

Growers and traders must be authorised to issue and/or attach NIPHL if they want to move plants and seeds for planting, seed potatoes or used agricultural and forestry machinery and vehicles from Great Britain to Northern Ireland.

Any business can get authorised to use the NIPHL scheme to move the following goods from GB to NI:

- Plants and seeds for planting

- Seed potatoes

- Used agricultural and forestry machinery and vehicles (UAFM)

For further information, please refer to the Northern Ireland Plant Health Label Scheme Checklist on NICTA and the Northern Ireland plant health label (NIPHL) scheme on GOV.UK.

TSS tip: Are your TSS Company Profile settings correct?

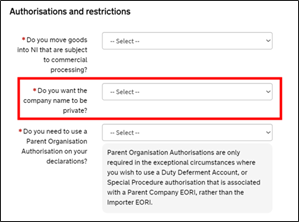

Avoid incorrect information on your declaration: check your TSS Company Profile settings

We urge all businesses with a TSS account to check that the information entered on their TSS Company Profile is correct. This includes all traders, hauliers, and carriers.

Why is this important?

The information from your TSS Company Profile can be used to populate data on your movements, so if the information is not correct on your profile, it may lead to incorrect information declared on your movement.

We would like to highlight one section in particular: ‘Do you want the company name to be private?’ If you select ‘Yes’, this means that your name and address is kept private and cannot be auto-populated into required fields on the movements by TSS.

Your EORI, company name and address are needed for movements on TSS. Selecting ‘Yes’ to this question means that for each movement your company name and address needs to be manually entered, as TSS cannot help populate the fields for the submitter.

- It is time consuming for the submitter to repeatedly enter this information.

- It can often lead to significant errors on the declaration as incorrect information is submitted.

How can I make this easier?

We urge you to check your privacy settings and ensure they are set to ‘No’ to optimise efficiency.

Where asked ‘Do you want the company name to be private?’ Selecting ‘No’ will allow TSS to automatically populate this information from your TSS company profile using your EORI number.

Will this mean that everyone has access to my information?

No, the submitter needs to know your EORI number, company name and address for the movement already, and on entering that EORI onto the movement, that is when the associated company name and address is populated from that company profile. It is not possible to access your information any other way. Your company name and address need to be entered on the movement regardless.

While you are reviewing your TSS Company Profile please check all sections are correct, and particularly the following:

- Company name – using the same details that you use in correspondence with HMRC

- EORI Number XI EORI number – where you have an XI EORI, this should be used

- Company address – this is your business registered address

Any fields marked with * are mandatory and must be completed on the company profile.

Further information is available in the Registration: Step-by-step guide to using TSS on NICTA.

If you require support changing any of these fields in your TSS Company Profile, you can contact the TSS contact centre for support.

Apply for a voluntary clearance amendment (underpayment) (C2001)

As of Wednesday 2 April, traders can use a new digital form to apply for a voluntary clearance amendment (or underpayment) that previously required a print and post form. Claims using the print and post form will no longer be accepted by HMRC after 31 May 2025.

You can find out more about the claims process on GOV.UK.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.