Contents

- New Certificates Exchange System (CERTEX) for Sanitary and Phytosanitary (SPS) controls goes live on 28 June 2025

- Tips to ensure the free flow of goods when using the simplified processes for Internal Market Movements

- TSS Tip: How to use the Templates and Copy function when submitting Entry Summary Declarations

- Pre-Movement Internal Market Movement Information (IMMI)

- Import Control System 2 (ICS2) RoRo changes to Entry Summary Declarations on TSS

- Are you using the correct commodity codes for your goods?

New Certificates Exchange System (CERTEX) for Sanitary and Phytosanitary (SPS) controls goes live on 28 June 2025

From 28 June 2025, licence data on Northern Ireland declarations will be verified by a new Certificates Exchange System (CERTEX), which is replacing the previous Automatic Licence Verification System (ALVS).

Guidance on CERTEX has been published in advance for trader’s awareness. See Moving licensed goods into or out of Northern Ireland on GOV.UK for further details and how this may affect you.

Further information on CERTEX and the upcoming new requirements will be provided in the next TSS Bulletin.

Tips to ensure the free flow of goods when using the simplified processes for Internal Market Movements

Movement Reference Numbers (MRNs) are required for the Goods Vehicle Movement Service (GVMS) to successfully tie the Entry Summary Declaration to the Internal Market Movement (IMMI).

If you are moving your goods by Roll-on Roll-off (Ro-Ro), you must obtain a Goods Movement Reference (GMR) from GVMS before boarding the ferry. This can be done using the Goods Vehicle Movement Service on GOV.UK, or through TSS.

GVMS requires both the Entry Summary Declaration MRN and the Internal Market Movement Information (IMMI) MRN to generate the GMR.

Once the Entry Summary Declaration is in ‘Authorised for Movement’ status and Internal Market Movement Information (IMMI) is in status ‘Awaiting Arrival’, TSS will email both MRNs to the haulier. These are:

- An Entry Summary Declaration MRN, starting with the year in which it is created followed by ‘XI’, for example 25XIXXXX

- An IMMI MRN, starting with the year it is created followed by ‘GB’, for example 25GBXXXX

If you are raising a GMR outside of TSS, you must quote both reference numbers when using GVMS.

Further details can be found in the Creating a Goods Movement Reference guide on NICTA.

Once the Internal Market Movement Information (IMMI) is submitted and the Entry Summary Declaration is marked as arrived, data can no longer be amended in TSS.

Please check that all the details on the IMMI are correct before submitting.

Once the Entry Summary Declaration is arrived, the IMMI will also be accepted, which means commodity codes, descriptions, procedure codes, weights, and other information, including categorisation, can no longer be changed in TSS.

Where necessary, incorrect information should be amended as you would with an international customs declaration post acceptance in the Customs Declaration Service (CDS), for example HMRC amendment requests. There is more information on how to Amend or cancel a Customs Declaration Service import declaration on GOV.UK.

TSS Tip: How to use the Templates and Copy function when submitting Entry Summary Declarations

Did you know you can use Templates or the Copy function when completing Entry Summary Declarations, to save you having to input the information manually every time?

Using Entry Summary Declaration templates in the TSS Portal

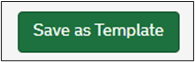

You can save the information from a goods line of an Entry Summary Declaration that is in ‘Authorised for Movement ‘or ‘Arrived’ status into a template to be reused by clicking the Save as Template button at the bottom of the form:

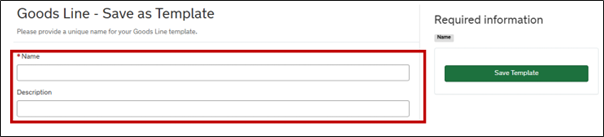

In the next screen, enter a unique name and a description of the goods template and then click Save Template:

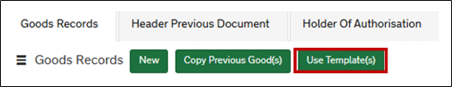

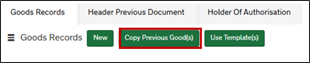

To apply the Goods Template information at the consignment (header) level of an Entry Summary Declaration, click on the Use Template(s) button in the Goods Records tab at the bottom of the form:

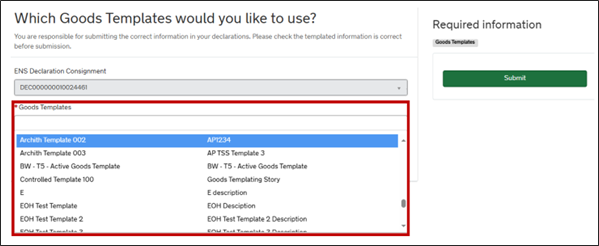

You will be prompted to select the template(s) you wish to use from the drop-down list or by direct input, and then click Submit:

Details from the Goods Templates you have submitted will be reflected in the Goods Records tab, where you can review details for each goods line and complete any remaining mandatory fields, including the Gross Mass field.

You can view and manage your templates from the Templates menu banner at the top of the TSS Portal:

![]()

Using the Entry Summary Declaration copy function in the TSS Portal

If you regularly move the same type of goods you can click on the Copy Previous Good(s) button to copy item level goods information from a previous Entry Summary Declaration:

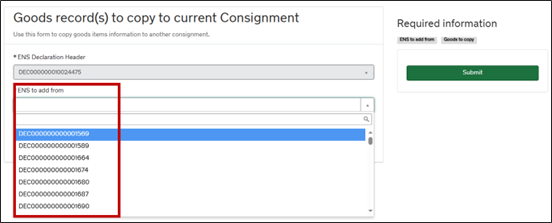

In the next screen, you can use the drop-down list or key in the Entry Summary Declaration you wish to copy from:

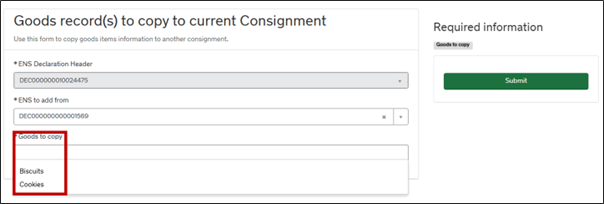

The next step is to select which goods to copy:

After clicking Submit, TSS populates all the data that is not affected by unique circumstances, such as document codes and authorisations, into the new Entry Summary Declaration.

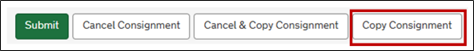

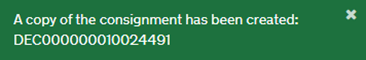

You can also use Copy Consignment functionality for creating new consignments populated with similar information:

All details, apart from certain document codes, will be copied into the new consignment. A pop-up box will advise that the consignment number that has been created:

Note: these functionalities are only supported on the Entry Summary Declaration – EIDR, Entry Summary Declaration – Simplified Frontier Declaration, or Entry Summary Declaration only journeys. They are not available for Internal Market Movement Information (IMMI) creation.

Further guidance can be found in the Entry Summary Declaration: Step-by-step guide on NICTA.

Pre-Movement Internal Market Movement Information (IMMI)

Did you know you can submit a Pre-Movement Internal Market Movement Information (IMMI) on the TSS Portal?

The functionality is available for all eligible goods movements using the new arrangements set out in the Windsor Framework.

For details on how to pre-lodge the IMMI in the TSS Portal, see the following NICTA guidance:

- Video: Using TSS to submit your Internal Market Movement Information

- Step-by-step guidance on how to submit pre-movement Internal Market Movement Information (IMMI)

To submit a Pre-Movement Internal Market Movement Information (IMMI) in the TSS Portal, you will need to ensure your company profile is set up accordingly, or if you are doing this on behalf of another TSS user, ensure that you have appropriate access and permissions to do so.

Import Control System 2 (ICS2) RoRo changes to Entry Summary Declarations on TSS

The Trader Support Service (TSS) has begun implementing changes to the Entry Summary Declaration submission process for movements made from Great Britain into Northern Ireland via Roll-on Roll-off (RoRo) to align with the introduction of Import Control System 2 (ICS2).

ICS2 has already been introduced in the TSS Portal for maritime movements into Northern Ireland. It is now being rolled out for movements by road, including RoRo, both unaccompanied and accompanied.

If you use TSS to submit your Entry Summary Declarations, we will onboard you.

Road carriers who do not use TSS when moving goods into Northern Ireland must start using ICS2 unless they have applied to use the Road Deployment Window for ICS2. Deployment windows must be requested as soon as possible from the Member State where the EORI is registered; they are not automatically applicable. Onboarding must be requested from HMRC by emailing [email protected].

Note: All carriers must complete the move from the existing Import Control System NI (ICS NI) to ICS2 by 1 September 2025. From 1 September 2025 onwards, road carriers who bring goods into Northern Ireland or the European Union will no longer be able to use the ICS NI system.

How ICS2 works

The ICS2 system manages:

- Lodging of pre-arrival Entry Summary Declarations

- Notification of the Arrival of goods

- Presentation of goods

- Assessment of safety and security risk

What does this mean for TSS users?

The Entry Summary Declaration submission process in the TSS Portal will be updated to meet the additional information requirements of the new system.

Key changes:

- You will need to identify on the Entry Summary Declaration whether the RoRo movement is unaccompanied or accompanied.

- The vessel International Maritime Organisation (IMO) number will be required along with the trailer identifier for unaccompanied movements.

- Names and addresses of the Carrier, Importer/Exporter, Consignor/Consignee, Buyer/Seller are required, alongside their EORI number where you have this. TSS are working on enhancements to support auto-population where possible.

- 6- or 8-digit HS codes and a detailed goods description are required for each of the goods.

TSS will continue to support the submission of Entry Summary Declarations for both RoRo accompanied and unaccompanied, as well as for maritime, which has been available since late 2024.

You can continue to use TSS to submit Entry Summary Declarations, meaning you will not need to register for ICS2 separately for movements made by RoRo.

The Arrival and Presentation of goods notifications, required by ICS2 for RoRo movements, will be supported by a new HMRC service. You will need to add all Entry Summary Declaration Movement Reference Numbers (MRNs) into the Goods Vehicle Movement Service (GVMS) to ensure Arrival and Presentation of goods notifications are sent to the ICS2 system.

When will the changes appear on the TSS Portal for Entry Summary Declaration submission?

Entry Summary Declaration submissions must be made on the new ICS2 system for RoRo movements from 1 September 2025 at the latest. TSS plans to allow submissions via both ICS NI or ICS2 systems from July 2025. This will enable users to transition to the updated process before the deadline. From 1 September onwards, only ICS2 process will be available when submitting Entry Summary Declarations using the TSS Portal.

TSS API users are currently able to start integrating with the new requirements in the TSS API test environment for unaccompanied movements and from early July for accompanied movements.

Where can I find more information?

TSS hosted an ICS2 webinar on Tuesday 3 June. The recording has been added to the Webinars and Recordings page on NICTA.

Are you using the correct commodity codes for your goods?

Commodity codes are a sequence of digits used in systems and paperwork to classify the items being moved and to check any applicable tariffs or controls. Choosing the correct commodity code helps avoid delays and ensures accurate duty payments.

The Harmonised System, managed by the World Customs Organization (WCO), standardises the first six digits of commodity codes for all member countries.

When moving goods to Northern Ireland (NI) that are ‘not at risk’ of onward movement to the EU you should consult the UK Integrated Online Tariff to classify your goods using up to ten digits, as may be required in TSS. For ‘at risk’ goods movements, the Northern Ireland Online Tariff should be used.

Consider the following when browsing the tariff:

- What are your goods?

- What are your goods made of?

- How were they produced?

- What is their function?

- How are they packaged?

You can search for a commodity code by entering the name of the goods directly into the Search function from the main menu of the UK Integrated Online Tariff or the Northern Ireland Online Tariff as follows:

Enter the goods name in the search box mid-way down the page

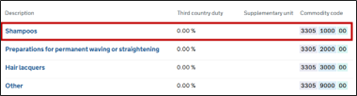

Alternatively, you can find the commodity code by browsing the tariff from the main menu and following the steps below to arrive at a 10-digit commodity code:

- Identify the relevant tariff section and chapters that apply.

- Specify the chapter.

- Determine the appropriate tariff heading.

- Select the subheading and commodity code. For example, for shampoos:

It is also possible to find the commodity code for your goods using the A-Z function from the main menu:

- Click on the letter relating to the name of the goods.

- Scroll to the name of the goods you are classifying.

Help and advice is available by webchat or email via the online tariff as well as the option to apply for an advance tariff ruling to obtain legal certainty. For further guidance, please see the How to identify your commodity codes guide on NICTA.

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.