Contents

- Import Control System 2 (ICS2) changes to Entry Summary Declarations for RoRo movements on TSS

- Common error on ICS2 consignments

- NICTA guide updates

- TSS Tip: Reduce the number of inputs required on your Supplementary Declaration

- When does the Supplementary Declaration need to be completed?

- How to download a Goods Movement Record or Declaration for your records

- UK businesses in Climate Change Agreements: report your 2024 annual subsidy award to HMRC

Import Control System 2 (ICS2) changes to Entry Summary Declarations for RoRo movements on TSS

The Trader Support Service (TSS) has been making changes to the Entry Summary Declaration form to support the requirements of the Import Control System 2 (ICS2). These updates became available from 14 July 2025, for use when submitting your Roll on Roll off (RoRo) Entry Summary Declarations via the TSS Portal.

What is ICS2?

ICS2 is the new safety and security information system for movements to Northern Ireland (NI) and the European Union (EU) that supports:

- Lodging of pre-arrival Entry Summary Declarations

- Notification of the Arrival of goods

- Presentation of goods

- Assessment of safety and security risk

ICS2 is replacing the existing Import Control System NI (ICS NI).

How does this affect submitting Entry Summary Declarations using the TSS Portal?

The Entry Summary Declaration submission process on the TSS Portal for RoRo movements has been updated to meet the additional information requirements of ICS2. On Monday 14 July 2025 the new movement type options became available when you submit your RoRo Entry Summary Declarations, and to familiarise yourself with the changes before they become mandatory from 1 September 2025. You do not need to sign up for the new service or register separately for ICS2 when submitting RoRo Entry Summary Declarations using the TSS Portal.

Key changes

- You need to identify on the Entry Summary Declaration whether the RoRo movement is Unaccompanied or Accompanied.

- Accompanied movements are where goods are transported on a vessel with the person transporting them, typically a driver (truck only, or truck and trailer).

- Unaccompanied movements are where goods are transported on a vessel without a driver present (trailer only, without a truck).

- The vessel International Maritime Organisation (IMO) number is required. For additional information and how to obtain the IMO number, see the definition in the NICTA Jargon Buster.

- Names and addresses of the Carrier, Importer/Exporter, Consignor/Consignee, Buyer/Seller, and place of delivery, are required alongside their EORI number where available.

- TSS will auto-populate this information where the party associated with the quoted EORI has not set their details to ‘private’ in their TSS Company Profile. Please encourage your supply chain partners to make their name and address details visible, as this helps to streamline the process of completing Entry Summary Declaration data for ICS2.

- A unique transport document number must be entered for your consignment.

- A 6-digit HS code and a detailed goods description (mass) are required for each of the goods.

- You need to stipulate whether your consignment is transported in containers, for example ‘40-foot closed-top shipping container’.

- Any additional information or supporting documents (e.g. licences and certificates).

Arrival and Presentation of goods notifications are now also required by ICS2. HMRC has built a new system called the Trader Interface Micro Service (TIMS) to submit these notifications on your behalf. You must include all Safety and Security Movement Reference Numbers (S&S MRNs) in your Goods Movement Reference so that TIMS can submit the ICS2 Arrival and Presentation of goods notifications for you. If you do not include the S&S MRN and use TIMS you must find an alternative way to complete these processes for your movement to be compliant.

Note for non TSS users: If you do not use the TSS Portal to submit Entry Summary Declarations, you must start submitting movements to ICS2 immediately, unless you have applied to HMRC to use the road deployment window for RoRo. Refer to the guidance about how to register to use the ICS2 on GOV.UK.

The move from the existing ICS NI to ICS2 must be completed by 1 September 2025, from when it will no longer be possible to use the ICS NI system to submit movement information.

Entry Summary Declarations for Maritime movements

ICS2 requirements are already in place on the TSS Portal for maritime movements from Great Britain (GB) to NI and you can continue using the TSS Portal for lodging pre-arrival Entry Summary Declarations for maritime movements. See the ENS step-by-step guide for maritime movements from GB to NI on NICTA. For the Arrival and Presentation of goods for maritime movements from GB to NI, you must submit details directly to ICS2, as this cannot be done through the TSS Portal.

Where can I find more information on ICS2?

- Consult the Entry Summary Declaration: Step-by-step guide on NICTA

- See how to Make an entry summary declaration using the Import Control System 2 on GOV.UK

- Refer to the Import Control System 2 (ICS2) information

TSS has hosted two webinars on ICS2:

- Introducing Changes to the Entry Summary Declaration due to ICS2

- Preparing for ENS changes in the TSS portal due to ICS2

These are hosted on the Webinars and Recordings page of the NICTA website, alongside previous TSS webinars and podcasts.

Common error on ICS2 consignments

Please ensure each consignment has a unique Transport Document Number (TDN) otherwise ICS2 will reject the declaration, which will have to be cancelled and a new consignment with a unique TDN will have to be created.

NICTA guide updates

Following the TSS Portal update on 13 July 2025, there have been some updates to the following guides on NICTA:

- Checklist: Entry Summary Declarations – for freight forwarders

- Checklist: Entry Summary Declarations – for hauliers and carriers

- Checklist: Entry Summary Declarations for traders of controlled goods

- Checklist: Entry Summary Declarations for traders of excise goods

- Checklist: Entry Summary Declarations for traders of SPS goods

- Checklist: Entry Summary Declarations for traders of standard goods

- Data guide: TSS declaration data requirements

- ENS step-by-step guide for maritime movements from GB to NI

- Entry Summary Declaration / Simplified Frontier Declaration Error Codes Guidance

- Entry Summary Declaration: Step-by-step guide

- Goods Description Guide

- How to identify your commodity codes

- Internal Market Movement Checklist for Hauliers

- Internal Market Movement Checklist for Traders

- Internal Market Movement Information (IMMI) Data Guide

- Pre-movement Internal Market Movement Information (IMMI): Step-by-Step guide

- Supplementary Declarations: Step-by-step guide

All TSS guides and more resources are available on NICTA.

TSS Tip: Reduce the number of inputs required on your Supplementary Declaration

The Import Previous Good(s) functionality allows you to copy the details of a ‘Closed’ Supplementary Declaration into one that is in ‘Draft’, or ‘Trader Input Required’ status and could reduce the amount of data manually input into the declaration(s). This means if you declare the same type of goods on a regular basis, you do not have to repeat all the steps to complete a Supplementary Declaration.

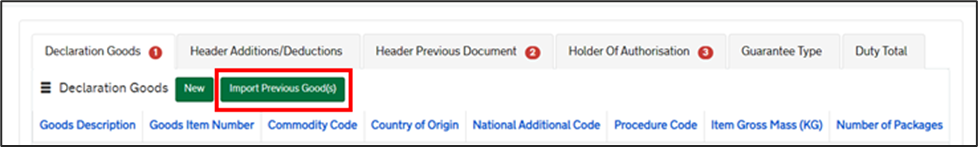

You can find this feature inside your Supplementary Declarations, under the Declaration Goods section at the bottom of the page:

Once you click on this button, it will open a new box where you can enter the ‘Closed’ Supplementary Declaration number and Goods Item line (indicated by Commodity Code and Goods Description) that you wish to use. The information you select will then be copied across to your current Supplementary Declaration. Once done, you can amend, add and/or update any details as needed such as the number of pieces, weight, value, and then process the declaration.

Additional information around this functionality can be found in the Step-by-step walkthrough of the TSS Supplementary Declaration section of the Supplementary Declarations: Step-by-step guide on NICTA.

When does the Supplementary Declaration need to be completed?

Submission of the Supplementary Declaration is required by the tenth calendar day of the month following the goods movement

Why does it have to be by the tenth calendar day?

When goods move using the TSS Simplified Procedure, where you delay the declaration and submit the information post movement on a Supplementary Declaration, you are using the TSS Simplified Declaration Procedure authorisation. The rules of using the TSS Simplified Procedure state that you agree to:

- Provide us with all Supplementary Declaration information, or where converted post movement, Internal Market Movement Information (IMMI), reasonably required by TSS and as notified to you using your Account contact details; and

- Make payment in advance for any duty that may become payable because of the provision of these services and in any event by the tenth calendar day of the month, following the month in which the goods subject to movement are transferred.

Please see the additional Trader Support Service terms and conditions.

How to download a Goods Movement Record or Declaration for your records

Did you know that you can download information from TSS on your Goods Movements and Declarations to save in your own records? Follow these steps:

- Navigate to Start a Goods Movement from the Goods Movement tab of the TSS Portal menu bar

- On the new page, scroll to and select the option Request download of a Goods Movement Record or Declaration.

- Use the Declaration Number field to enter the goods movement number you would like to export a copy of or select from the dropdown list. For reference, please note that:

- Internal Market Movement Information (IMMI) starts with ‘GLR’

- Entry Summary Declarations start with ‘ENS’

- Supplementary Declarations start with ‘SUP’

- Consignment (header) level declarations start with ‘DEC’

- Simplified Frontier Declarations start with ‘SFD’

- Full Frontier Declarations start with ‘FFD’

- Once you have chosen, click Submit.

- A pop-up box will confirm that your request was submitted and that TSS will email you a link to your document shortly. You should allow ten minutes for it to arrive.

- The PDF will be sent to you by email.

UK businesses in Climate Change Agreements: report your 2024 annual subsidy award to HMRC

HMRC is required to collect and publish details of annual tax subsidies awarded to UK businesses in Climate Change Agreements (CCA) over a defined threshold to ensure transparency and accountability.

HMRC has now launched its data collection exercise for calendar year 2024, for the reporting period 1 January to 31 December 2024.

If your business is in a CCA and receives annual subsidies exceeding £100,000 from Climate Change Levy (CCL), you’re required to report this information to HMRC by 30 September 2025.

Subsidy reporting requirements:

- Reporting period: HMRC is collecting CCA subsidy award information for calendar year 2024 (1 January to 31 December 2024).

- Threshold: if your subsidy award for 2024 is over £100,000, you must complete the online form on GOV.UK by 30 September 2025.

- Northern Ireland businesses: if your business is registered in Northern Ireland and trades in goods or the wholesale electricity market, you’ll need to report your annual CCA subsidy award if it exceeds 100,000 euros, which is £84,825 when converted to British pounds. Visit GOV.UK to find more information on which businesses are in scope.

Visit GOV.UK for further details about reporting your CCA subsidies to HMRC, including how to calculate your annual subsidy award: Report Climate Change Levy subsidies to HMRC.

What you need to do

- Check your records: review your documentation to see if you meet the threshold requirements.

- Complete the online form: visit GOV.UK to access further guidance.

- Ensure you submit this information by 30 September 2025.

Please be aware, if you’re reporting as a VAT group, you should report the representative member’s name only and apply the threshold requirements at the group level.

For any queries, please contact [email protected].

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.