Contents

- Windsor Framework now live

- Forthcoming changes to Safety & Security Entry Summary Declarations on TSS

- June webinar on changes to Entry Summary Declarations on TSS

- Moving controlled goods in the TSS Portal

- Reducing error messages and Trader Input Required (TIRs) when moving controlled goods using TSS

- TSS tip: Are you following the correct process in GVMS for your movements?

- Windsor Framework guidance available on NICTA

Windsor Framework now live

The new arrangements for the movement of goods from Great Britain (GB) to Northern Ireland (NI) by parcels or freight as set out in the Windsor Framework took effect on 1 May 2025.

For business-to-business (B2B) parcel movements, there are new processes that you will need to follow to ensure goods continue to move quickly and smoothly. For existing freight movements, new simplified processes have been introduced which traders may wish to take advantage of. Key information about these arrangements can be found on GOV.UK:

- Internal Market Movements from Great Britain to Northern Ireland

- Communications resources to help you move goods from Great Britain to Northern Ireland

Forthcoming changes to Safety & Security Entry Summary Declarations on TSS

Over the course of this summer, TSS will be implementing changes to the Entry Summary Declaration submission process for Roll-on Roll-off (Ro-Ro) movements into Northern Ireland (NI) to align with the introduction of Import Control System 2 (ICS2).

ICS2 is being introduced in phases by type of movement and has already been introduced for air and sea/maritime movements into NI. It is now being introduced for movements by road, which includes Ro-Ro movements, both Unaccompanied and Accompanied.

This means:

- Road carriers who bring goods into NI or the EU must start using ICS2 now unless they have applied to use the Road Deployment Window for ICS2. Deployment windows must be requested from the Member State where EORI is registered as they are not automatically applicable. Onboarding must be requested from HMRC by emailing [email protected]. If traders have not already requested use of the deployment window, they must request this from HMRC as soon as possible.

- If you already engage the Trader Support Service for your declarations, they will onboard you into the relevant deployment window to align with their services.

- All traders must complete the move from Import Control System NI (ICS-NI) to ICS2 by 1 September 2025, because from that date onwards road carriers who bring goods into NI or the EU will no longer be able to use the existing ICS-NI system.

How ICS2 works

The ICS2 system manages:

- Lodging of pre-arrival Entry Summary Declarations

- Notification of arrival of goods

- Presentation of goods

- Assessment of safety and security risk

What does this mean for TSS Users?

The introduction of ICS2 will mean that the Entry Summary Declaration submission process on the TSS Portal will be updated to meet the information requirements of the new system.

Key changes:

- You will need to identify on the Entry Summary Declaration whether the movement is unaccompanied or accompanied.

- The vessel International Maritime Organisation (IMO) number will be required along with the trailer identifier for unaccompanied movements.

- Names and addresses of the Carrier, Importer/Exporter, Consignor/Consignee are required, alongside their EORI number where you have this – TSS will help by filling in this information where possible.

- A 6-digit HS code and goods description are required for each of the goods you are moving.

TSS will continue to support the filing of Entry Summary Declaration submissions. The Arrival and Presentation of Goods processes required by ICS2 will be supported by a new HMRC service that will require you to enter all Entry Summary Declaration Movement Reference Numbers (MRNs) into GVMS to gain a Goods Movement Reference (GMR) number for the movement.

You can continue to use TSS to submit Entry Summary Declarations, so you won’t need to register for ICS2 separately unless you want to receive notifications from the system.

When will the changes appear on the TSS Portal for Entry Summary Declaration submission?

Entry Summary Declaration submissions must use the new ICS2 system for Ro-Ro movements from 1 September 2025 onwards. To support user transition to the new requirements, TSS plans to allow submissions via both ICS-NI or ICS2 systems from July 2025. This will enable users to transition to the updated process before the 1 September deadline. From 1 September onwards only ICS2 process will be available when submitting Entry Summary Declarations using the TSS Portal.

TSS API users will be able to start integrating with the new requirements in the TSS API test environment from mid-May for unaccompanied movements and early July for accompanied movements.

Where can I find more information?

Information will be updated in due course, but for now you can find information on how to submit an Entry Summary Declaration on both GOV.UK and NICTA:

- Making an entry summary declaration on GOV.UK

- Current Ro-Ro guidance on NICTA: Entry Summary Declaration: Step-by-Step guide

- Current maritime guidance on NICTA: ENS step-by-step guide for maritime movements from GB to NI

Further TSS information will be published on NICTA as functionality becomes available over the coming weeks.

June webinar on changes to Entry Summary Declarations on TSS

TSS will be hosting our next webinar – Introducing Changes to the Entry Summary Declaration due to ICS2 – at 3pm BST on Tuesday 3 June. You may find this introductory webinar useful if you are a Trader or Haulier moving goods from Great Britain to Northern Ireland and want to understand what the change to ICS2 means for you

The phased introduction of Import Control System 2 (ICS2) by movement type began last year. Changes for air and maritime have already been implemented. The purpose of this webinar is to provide context for the final phase, specifically for road and rail movements, and to share information that will help you prepare for the relevant TSS Portal updates.

We will cover the following topics:

- An introduction from HMRC on ICS2 changes

- What ICS2 means for TSS users

- An overview of what is changing

- The timeline for change and further support available

- Q&A

Event speakers include:

- Shanker Singham | TSS Customs and Trade Policy Lead

- Doreen Crawford | TSS Stakeholder Manager

- Piers Micklem | HMRC Customs Policy Advisor

- Lisa Khan | HMRC External Readiness Manager ICS2

Register now

There are limited spaces available, so please make sure you register for the webinar. Questions can be submitted in advance as part of registration and are invaluable in shaping our future engagements. Once registered, we will issue instructions on how to join the webinar closer to the time of the event.

Please be aware that this session will be recorded and uploaded to NICTA, where you can find further learning resources, including the recordings of previous TSS webinars and further learning resources.

Moving controlled goods in the TSS Portal

If you are transporting controlled goods, additional information will be required on your Entry Summary Declaration. When moving goods that may need licences, authorisations, or certificates, it is important to verify if your goods are subject to other requirements from additional government agencies.

For further details on transporting controlled goods, how to identify if your goods are controlled and guidance on how to navigate the Northern Ireland Online Tariff, please refer to the Guidance on controlled goods and the Online Tariff Tool on NICTA.

If you are transporting these goods using the TSS Simplified Procedure, it may be necessary to declare additional information during the Entry Summary Declaration stage as TSS will utilise information from the Entry Summary Declaration to create a Simplified Frontier Declaration (if applicable).

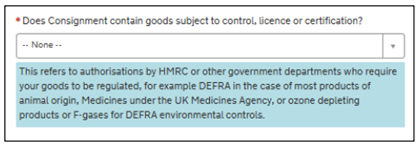

You must declare the goods as controlled in TSS to generate the Simplified Frontier Declaration, including any licence, authorisation, or certificates at the Entry Summary Declaration item level. You can do this by selecting ‘Yes’ to the question ‘Does Consignment contain goods subject to control, licence or certification?’ when completing the Entry Summary Declaration.

Step-by step-guidance on completing the Entry Summary Declaration in the TSS Portal is available in the Entry Summary Declaration: Step-by-step guide on NICTA.

Upon submission of the Entry Summary Declaration or Simplified Frontier Declaration, TSS will validate the submission to ensure all required data and document references are present. The TSS Portal will issue an error message outlining any missing information so users can rectify the entry before submission.

It is important to include the MRN of the Simplified Frontier Declaration into GVMS to ensure that the goods are ‘arrived’ and presented in Northern Ireland, to meet your legal obligations.

Categories of controlled goods

To check if your goods are controlled, refer to the Northern Ireland Online Tariff on GOV.UK. For guidance on how to navigate the Northern Ireland Online Tariff see the Guidance on controlled goods and the Online Tariff Tool on NICTA.

Some examples of controlled goods:

- Sanitary and Phytosanitary (SPS) Goods

- Products of animal origin or fish

- Plant, plant products, timber-based products

- Agri-Foods

- Controlled goods requiring import licences

- Excise Goods

- Fluorinated gases & ozone depleting substances

This list is not exhaustive. For a list of full licence types for import, refer to GOV.UK.

Reducing error messages and Trader Input Required (TIRs) when moving controlled goods using TSS

Errors in manual input of movement information can cause delays with processing and may affect your declaration submissions, particularly when you need a licence or document such as a Common Health Entry Document (CHED).

The Customs Declaration Service (CDS) will check that the information entered on the TSS Portal matches your licence details. If the information doesn’t match, then it will return a TIR error which you will need to correct before the goods move.

You can increase first time acceptance of your movements and avoid any delays by checking that your licence information matches your movement on TSS (for example, on a Simplified Frontier Declaration). Does the following on TSS match your licence or CHED?

- Commodity codes

- Weights

- Quantities

- CHED or licence information, and that it is the correct format that CDS requires

If you have many lines of commodities in one CHED or many CHEDs in one declaration, check these carefully before you submit.

What is a CHED?

- A notification of imports of food, feed and plants to authorities

- Submitted in advance of good arriving in Northern Ireland

- Supports biosecurity (through checks at the border for some goods) and traceability of foodstuffs

CHED references are provided in customs import declarations. An example of a CHED reference is: CHEDD.FR.2024.1234567.

What are controlled goods?

Controlled goods are those that require additional licences, documentation or authorisations to be provided before being moved from GB to NI. Some common examples are:

- Excise goods

- Goods requiring export licences

- Common Agricultural Policy (CAP) goods

For more information, please visit the Guidance on controlled goods and the Online Tariff Tool on NICTA.

TSS tip: Are you following the correct process in GVMS for your movements?

Bulletin 193 included information on changes to GVMS for goods moved using the TSS Simplified Procedure (see the article: How to complete your GMR when you use the TSS Simplified Procedure journey for standard goods).

Following this, this article clarifies the information required for all goods movements available on the TSS Portal from GB to NI that use GVMS. Detailed guidance on the GMR and step-by-step instructions on how to complete a GMR in GVMS can be found in Creating a Goods Movement Reference on NICTA.

Standard Goods using the TSS Simplified Procedure journey on NICTA

Standard goods that move with the Entry in Declarants Records (EIDR) process submitted pre-movement and a Supplementary Declaration submitted post movement. This can be completed on the TSS Portal and the TSS reference begins with a DEC.

What information do you need for GVMS? The Entry Summary Declaration MRN and the Trader EORI, Local Reference Number (LRN) and the Procedure Code, are required on the GMR to meet Notice of Presentation (NOP) requirements.

Controlled Goods using the TSS Simplified Procedure journey

Controlled goods that move with the Simplified Frontier Declaration submitted pre-movement and a Supplementary Declaration submitted post movement. This can be completed on the TSS Portal and the TSS reference begins with a Simplified Frontier Declaration.

What information do you need for GVMS? The Entry Summary Declaration MRN and the Simplified Frontier Declaration MRN.

Internal Market Movements

Goods that move with the Internal Market Movement Information (IMMI) submitted pre-movement and no declaration needed post movement. This can be completed on the TSS Portal and the TSS reference begins with a GLR.

What information do you need for GVMS? The Entry Summary Declaration MRN and the Internal Market Movement Information (IMMI) MRN.

Full Frontier Movements

Goods that move with the Full Frontier Declaration submitted pre-movement and no declaration needed post movement. This can be completed on the TSS Portal and the TSS reference begins with a Full Frontier Declaration.

What information do you need for GVMS?

The Entry Summary Declaration MRN and the Full Frontier Declaration MRN.

What is an MRN and how do I get the MRN information for GVMS?

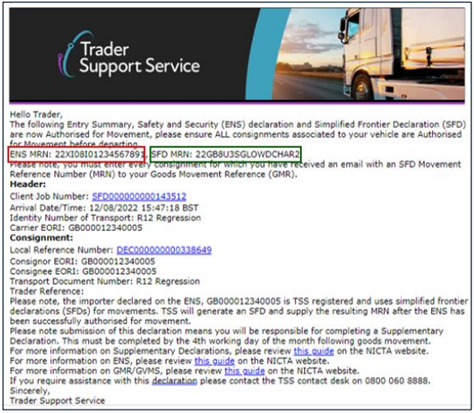

A Movement Reference Number (MRN) is usually 18 characters long, beginning with two numbers of the year it was generated (for example, 25 for 2025) followed by the two-letter country code (GB is Great Britain and XI is Northern Ireland).

How do I get the MRN information for GVMS?

When you use the TSS Portal to submit this information, you will receive an email with the MRN and information you require for GVMS, if you are submitting this information manually.

Example email:

TSS can send the information to GVMS on your behalf, reducing the effort and potential errors when adding in the MRN information to GVMS for your movements. This service is called GMR Automation, and you can set this up on your TSS Company Profile. There is information on how to do this in the ‘Step-by-step GMR creation via the TSS Portal (GMR automation)’ section in the Creating a Goods Movement Reference guide on NICTA.

Windsor Framework guidance available on NICTA

On NICTA there are guides to help you with the Windsor Framework simplified processes. Clicking on the Moving Goods from Great Britain to Northern Ireland option on the menu bar at the top of any page will direct you to further information concerning Internal Market Movement.

- Internal Market Movement Checklist for Traders

- Internal Market Movement Checklist for Hauliers

- Simplified processes for Internal Market Movements – Introduction guide

- TSS Permissions Management for TGP and UKIMS

- Trader Goods Profile (TGP) Guide

- Internal Market Movement Information (IMMI) Data Guide

- Internal Market Movement Information (IMMI) Procedures and Additional Procedure Codes Guide

- Video: Preparing for the Windsor Framework using the TSS Portal

- Video: Preparing for the Windsor Framework using the Trader Goods Profile

- Video: Using TSS to submit your Internal Market Movement information

TSS Contact Centre hours of operation:

07:30 – 22:30, 7 days a week

Contact options

Tel:0800 060 8888

Welsh speakers Tel: 0800 060 8988

Northern Ireland Customs & Trade Academy (NICTA)

Find guides, webinars, and training on the NICTA website to assist with your customs movements and using TSS.