This guide introduces the Trader Support Service (TSS), and gives an overview to the processes involved in moving goods into Northern Ireland as part of the Windsor Framework arrangements and key customs procedures.

If there are any words or acronyms in this document that are unfamiliar, you can visit the Jargon Buster or use the search tool on the Northern Ireland Customs & Trade Academy (NICTA) website to find a definition.

Terms used in this guide refer to the terminology used on the TSS Portal. Please note that these may not match the most recent terms used on GOV.UK, in HMRC’s Customs Declaration System or the Northern Ireland Online Tariff on GOV.UK.

Contents

How the Trader Support Service (TSS) can support you

Changes to goods movements into Northern Ireland since 1 January 2021

Since 1 January 2021 there are new steps you must take when moving goods into Northern Ireland (NI):

- Customs declarations and safety and security declarations are now required on goods movements

- Additional requirements are in place for certain types of goods

- Duty may need to be paid on goods deemed ‘at risk’ of moving into the European Union (EU)

What this means for you

These changes mean that traders now need to:

- Submit information about goods and movements before goods are sent

- Check if the goods you are moving require additional authorisations and documents

- Check if your goods attract duty and what you can do to be exempt from payment

Support offered by the Trader Support Service

The Trader Support Service (TSS) offers a simple and free-to-use service to help you move goods to and from Northern Ireland.

When moving goods to and from NI, TSS helps you understand and meet new customs requirements by providing a portal where traders and their intermediaries can submit required customs declarations.

TSS helps you meet these requirements by providing support and guidance online and by phone, including:

- General customs training through online courses and Guidance on using TSS services on the Northern Ireland Customs and Trade Academy (NICTA)

- Contact centre support from agents with customs expertise

How to get started with TSS

To move goods NI, you will need an Economic Operators Registration and Identification number (EORI number) that starts with XI. For more information on how to get an EORI number please see the guidance on GOV.UK.

You can register for the TSS as a trader or an agent acting as an intermediary.

There are two key roles in the TSS process:

- Haulier: the organisation responsible for ensuring your movement to NI is authorised before the goods arrive at the frontier (this may be performed by a freight forwarder or carrier)

- Importer: the organisation responsible for the import declaration (this is either the sender or receiver of goods, most often the business receiving the goods in NI)

Northern Ireland Economic Operators Registration and Identification numbers (XI EORIs) are issued to businesses that are established or have a permanent business establishment in NI, where required. However, those businesses not established can still register in specific cases:

- To submit a safety and security declaration (also known as an Entry Summary Declaration), or use TSS to do so

- To submit a customs declaration for temporary storage declaration

- To submit a customs declaration for temporary admission or re-export declaration where they would need to get a guarantee

- To submit a transit declaration

Note:

- You can only add Simplified Customs Declaration Process (SCDP), formerly known as Customs Freight Simplified Procedure (CFSP), authorisations that are associated with an XI EORI

- The EORI and SCDP authorisation(s) references reported in your Company Profile need to be valid and updated as per regulation requirements (see GOV.UK)

What you need to do before you start moving goods

Determine if your goods are 'at risk' or 'not at risk'

What are 'at risk' and 'not at risk' goods?

Goods that can be shown to remain in NI and the UK’s customs territory will not be subject to EU tariffs.

- Goods are deemed ‘at risk’ when there is a possibility that they will be moved out of the UK domestic market into the EU after their arrival in NI

- Goods are ‘not at risk’ if, after their arrival in NI, they are going to remain or be consumed within the UK domestic market and there is a UK Internal Market Scheme (UKIMS) authorisation in place supporting this claim

It is the importer’s responsibility to determine if goods moving into NI are ‘at risk’ of moving to the EU.

For more support, read the GOV.UK guidance on declaring goods you bring into NI ‘not at risk’ of moving to the EU.

How to declare goods ‘not at risk’

The UK Internal Market Scheme (UKIMS) is a scheme that allows traders to declare their goods ‘not at risk’.

The scheme is an authorisation for the movement of ‘not at risk’ goods into NI. Once the Windsor Framework is fully delivered, UKIMS will provide access to the simplified processes for Internal Market Movements (SPIMM), which means that goods staying in the UK will be freed of unnecessary paperwork, checks and duties, with only ordinary commercial information required.

If you want to join UKIMS you will need to apply online.

You can find more about the requirements, eligibility criteria and how to apply for UKIMS authorisation on GOV.UK.

Determine if you are moving standard or controlled goods

To comply with customs and legal requirements, you must establish if any of the goods you are moving are controlled goods.

Within TSS, controlled goods are defined as those that are subject to special regulation, certification, licensing or other approvals. This includes not only HMRC customs-controlled goods, such as excise goods, but also goods that are subject to authorisations by any other government department, such as sanitary and phytosanitary goods.

The importer and haulier are both responsible for determining if the goods they are moving are controlled.

Sanitary and phytosanitary goods

Sanitary and phytosanitary goods are a category of controlled goods that must comply with EU rules on sanitary and phytosanitary (SPS) products and animals trade, as per the Windsor Framework. Such goods are regulated by the Department for Environment, Food and Rural Affairs (DEFRA) in GB and the Department of Agriculture, Environment and Rural Affairs (DAERA) in NI.

How to determine if your goods are controlled

There are several ways of finding out if your goods are controlled:

- Refer to the Guidance on controlled goods and the Online Tariff Tool on NICTA

- Use the Northern Ireland Online Tariff tool on GOV.UK to see what license, certificates and measures you need to provide

- Refer to the Northern Irish Department of Agriculture, Environment and Rural Affairs guidance on Sanitary and phytosanitary checks and Points of Entry for types of checks your goods might face

- Check the Movement Assistance Scheme on GOV.UK for ways to help reduce inspection costs

Note: There are some goods where permits or certifications may not be directly required, such as excise, but that fall under the remit of controlled goods. For example, this could include some food products due to the percentage of ingredients or the cooking process or if the product is being imported for research or diagnostic purposes (such as blood samples, swabs, or food samples for analysis).

In some instances, goods are classified as controlled according to the guidance, but are not classified as controlled when moved from GB to NI. To check if this applies to your goods, refer to the Northern Ireland Online Tariff on GOV.UK and the respective GOV.UK guidance on the Data Element 2/3: Documents and Other Reference Codes (Union) of the Customs Declaration Service.

Determine if you have to pay custom duty

Tariffs and customs duty are taxes imposed by governments on imported goods. The Windsor Framework has confirmed that only goods ‘at risk’ of entering the EU Single Market (i.e., not those remaining in NI) should pay EU tariffs or customs duty.

Different tariff exemptions and relief options are available, as shown in the table below.

It is the responsibility of the importer to determine the duties and taxes due on a goods movement.

| Tariff option | >Description |

|---|---|

| UKIMS | If you hold UKIMS authorisation, you don’t have to pay EU duty when moving goods declared ‘not at risk’. |

| Preferential tariff | Under the EU–UK Trade and Cooperation Agreement (TCA), Preferential tariff rates enable you to pay zero or reduced EU tariff duty rates on goods proven to be of UK origin. |

| Customs Duty waivers | A customs duty waiver enables you to waiver up to €300,000 in EU duty payments over three tax years. This option is often used when moving low volumes of goods infrequently. |

| Duty relief by procedure | Certain customs procedures allow all traders with appropriate authorisations to claim duty suspension or relief subject to certain conditions. |

How you can claim tariff duty exemption

Tariff duty exemptions can be claimed when completing your customs declaration on the TSS Portal. More detailed information about tariff options can be found in the Tariffs on goods movements into NI guide on NICTA.

How to determine which declaration path you need to follow

TSS fully supports two main customs declarations paths, which cover a high proportion of goods movements to NI. The declaration path you will need to follow may be determined by where you are moving goods from and the type or value of goods.

The two main customs declaration paths are:

- The TSS simplified journey: the TSS simplified journey allows businesses to move goods from GB into NI using a reduced level of information before goods movement and a full electronic customs declaration after goods movements

- The TSS Full Frontier journey: the TSS Full Frontier Declaration path requires you to submit all information on your declaration and pay any necessary duties at the same time, generally before the goods move into NI. Movements from Rest of World excluding the European Union (RoW excluding EU) or movements into inventory-linked locations have to use the TSS Full Frontier Declaration path.

Most traders will follow the TSS simplified journey when importing goods from GB to NI.

However, some goods movements may require an alternative declaration path. Alternate declaration paths supported (or partially supported) by TSS include:

- Oral and by conduct Declarations: Some goods, such as those intended for re-export, may be declared using an oral or by conduct declaration, which does not require a written declaration. See the Oral Declarations: Checklist for traders on NICTA for more information

- Goods movements from Great Britain to Northern Ireland via Ireland (transit procedure): If you are moving goods to NI via Ireland, you will need to consider the transit procedure. See the TSS Transit service: a step-by-step guide for traders on NICTA for more information

- Goods movements from Northern Ireland to Great Britain (either direct or via Ireland): Customs declarations are only required in some circumstances for goods movements from NI to GB. See the Movement of Goods from NI to GB: Step-by-step guide on NICTA for more information

If your journey is not covered here, or if you have any questions about declaration requirements for your journey, you can get assistance from the TSS Contact Centre.

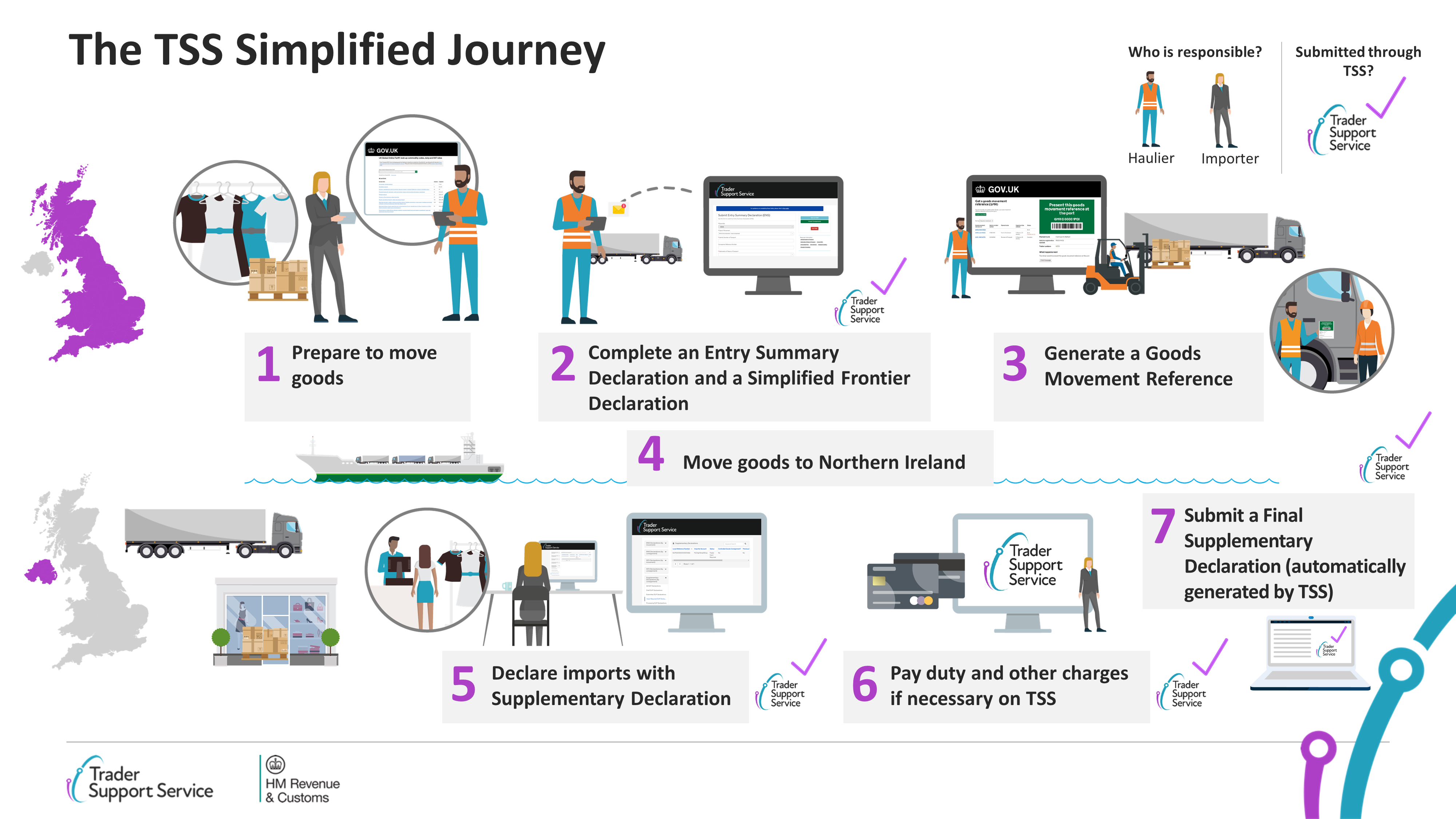

The TSS simplified journey

The main steps to the TSS simplified journey are:

- Prepare to move goods

- Complete an Entry Summary Declaration and a Simplified Frontier Declaration on the TSS Portal (the Simplified Frontier Declaration is usually auto-generated by TSS)

- Generate a Goods Movement Reference (GMR, if moving goods on a trailer and ferry, often referred to as RoRo). Please refer to the section in this guide on Generating a Goods Movement Reference

- Move goods to Northern Ireland

- Declare imports with a Supplementary Declaration on the TSS Portal

- Pay duty and other charges, if necessary, on TSS

- Submit a Final Supplementary Declaration (done automatically for you by TSS)

Here is a visualisation of the TSS simplified journey:

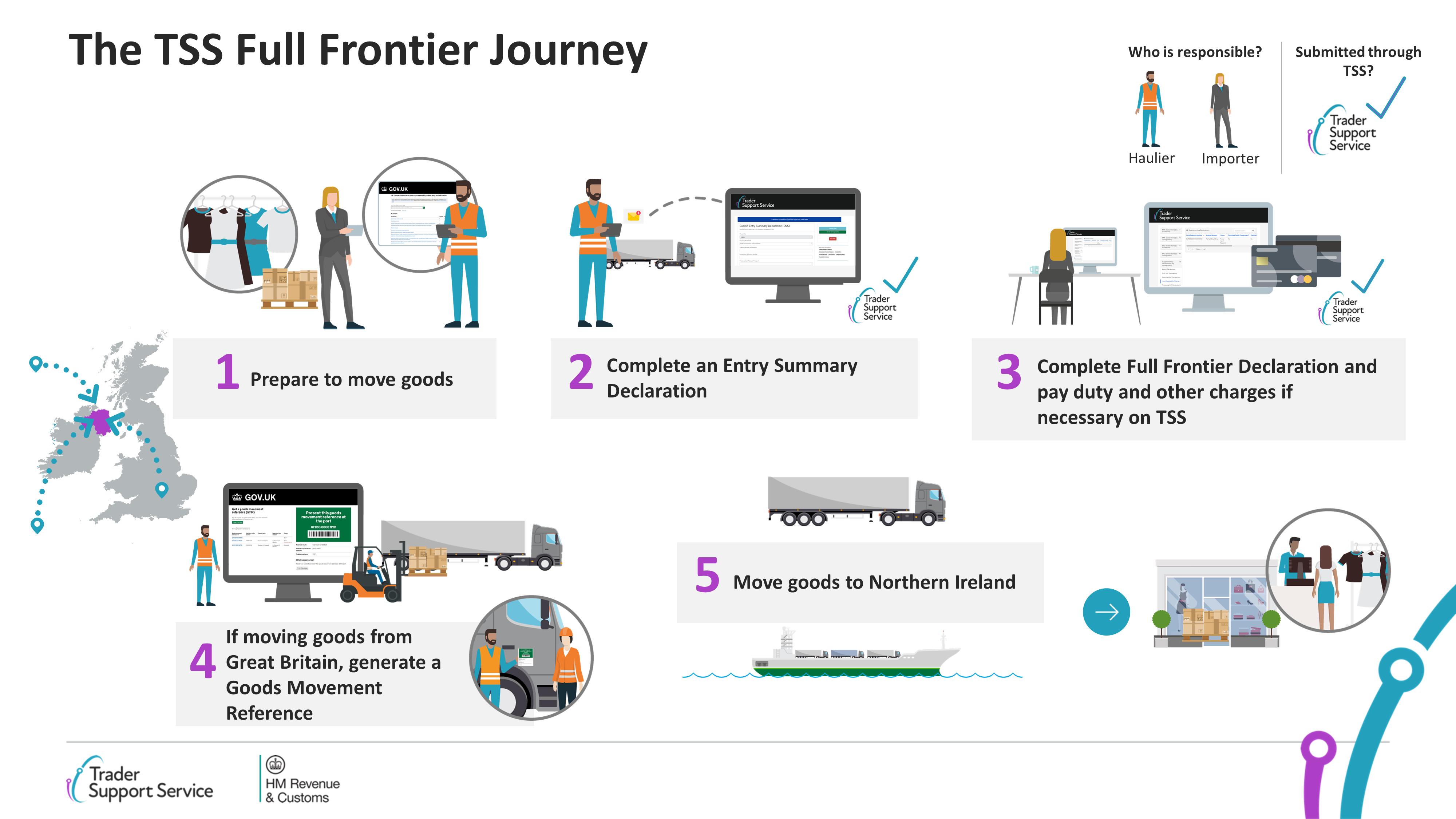

The TSS Full Frontier journey

The main steps to the TSS Full Frontier journey are usually:

- Prepare to move goods

- Complete an Entry Summary Declaration on TSS or equivalent safety and security declaration

- Complete a Full Frontier Declaration and pay duty and other charges, if necessary, on TSS

- If moving goods from GB to NI via RoRo, generate a GMR. Further details can be found in the Generating a Goods Movement Reference section of this guide

- Move goods to NI

There is a visualisation of the TSS Full Frontier Journey below. Note: Full Frontier Declarations may also be submitted after the goods movement for air and maritime journeys. See the Full Frontier Declaration: Step-by-step guide for full details.

What you need to do to complete the TSS customs process

There are five steps that apply to most goods movements using TSS:

- Preparing to move goods

- Completing an Entry Summary Declaration

- Completing your customs declaration

- Generating a Goods Movement Reference and transporting goods

- Paying duties if necessary

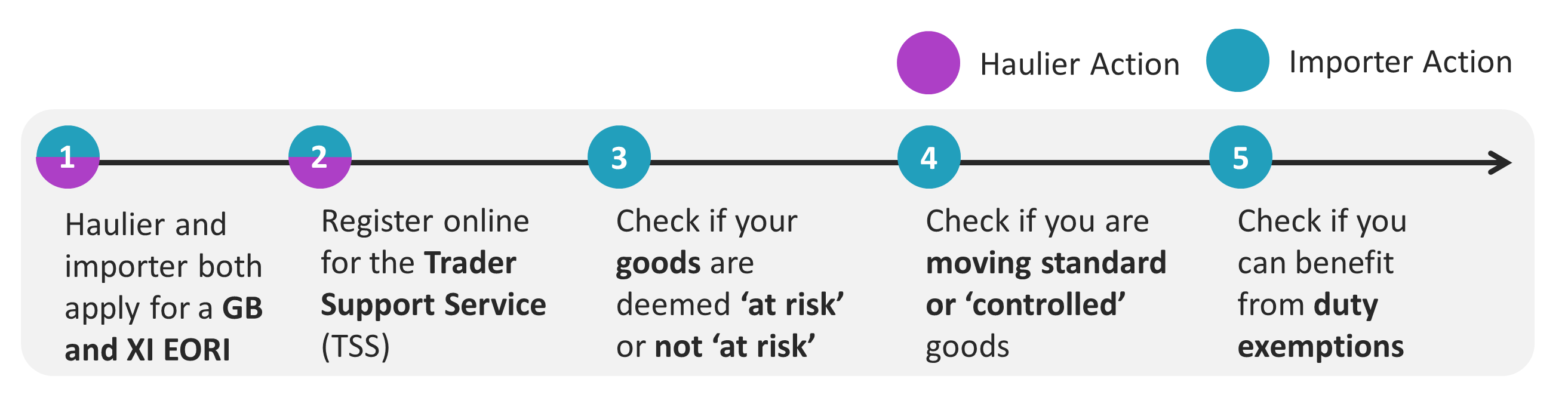

Preparing to move goods

Before you start your goods movements, you should perform the following steps:

- Haulier and importer both apply for a GB and XI EORI

- Register online for the Trader Support Service (TSS)

- Check if your goods are deemed 'at risk' or 'not at risk'

- Check if you are moving standard or 'controlled' goods

- Check if you can benefit from duty exemptions for EU duty

Both the haulier and importer are involved in preparing for a goods movement.

Here is a visualisation of the steps to prepare to move goods:

Both the importer and haulier will receive an individual GB and XI EORI number. Please ensure you update your TSS Company profile with the relevant XI EORI numbers prior to moving goods and submitting any declarations on TSS.

Things to remember:

- Use the Guidance on controlled goods and the Online Tariff Tool on NICTA to find out if you are moving non-controlled or controlled goods. Read the section in this guide on how to Determine if you are moving standard or controlled goods for additional support to get started

- After applying for a GB or XI EORI number, it could take up to five working days to be issued

- Make sure you have the correct certificates and licences if you’re moving controlled goods that are not excise goods

- If you’re an importer, make sure you keep a record of goods within each movement

- If you are importing goods from the RoW excluding EU, you will also require GB and XI EORI numbers to submit your declaration via TSS

For further information and help:

- You can apply for GB and XI EORI numbers at GOV.UK

- Register for the TSS

- Read the section above on how to Determine if your goods 'at risk' or 'not at risk'

- Read the section above on how to Determine if you are moving standard or controlled goods

- Read the section above on how to Determine if you have to pay custom duty

Completing an Entry Summary Declaration

The Entry Summary Declaration provides UK customs and Border Force with pre-arrival information on goods, for safety and security purposes. The declaration must be completed (either within TSS or outside of TSS) before any physical movement of goods.

You obtain an Entry Summary Declaration with TSS by populating the form on the TSS Portal.

Note: This does not apply if your goods movement is exempt from making an Entry Summary Declaration. You can find out if your goods movement is exempt by checking if you need to make an Entry Summary Declaration on GOV.UK.

The haulier (or party acting as the haulier) holds responsibility for completing the Entry Summary Declaration or equivalent safety and security declaration.

After submitting the Entry Summary Declaration, the haulier will receive an Entry Summary Movement Reference Number via email. Importers will need to use this reference number when completing their declaration.

Things to remember:

- Know your importer and their GB and XI EORI number

- If following the TSS simplified journey, ensure the importer is registered on TSS to receive an auto-generated Simplified Frontier Declaration

NOTE: This only applies to the TSS simplified journey. There are further details on journeys requiring Full Frontier Declarations in the Entry Summary Declaration and Full Frontier Declaration guidance on NICTA - Ensure you have movement and goods information available (for example, journey details, goods description, licenses for controlled goods)

- There is a process for groupage transport, whereby information can be submitted at consignment (header) level and consolidated pre-movement

For further information and help:

- Review the Data guide: TSS declaration data requirements for help with completing an Entry Summary Declaration

- Read the ENS Step-by-step guide: Standard Process and Consignment First Process for details on the declaration process and how to submit information at consignment (header) level

- Watch a video on how to create and submit an Entry Summary Declaration

Completing your customs declaration

Before you start, make sure you have confirmed which is the correct declaration path to follow and communicate this with your haulier.

It is the responsibility of the importer to ensure all required customs declarations are completed.

Customs declarations on the TSS simplified journey

If you are following the TSS simplified journey, TSS will usually auto-generate a Simplified Frontier Declaration for you from the information provided in the Entry Summary Declaration. The Simplified Frontier Declaration is the first part of the customs declaration and is made before goods movement using a reduced level of information.

Once your goods have moved, the importer will receive a notification to complete a Supplementary Declaration.

- If you are following the TSS simplified journey, remember to complete your Supplementary Declaration once your goods have arrived in NI

The Supplementary Declaration requires full information (see the Data guide: TSS declaration data requirements on NICTA) and is always completed after the goods move. This is used to close the customs journey and pay any required duties and other charges. Submission of the Supplementary Declaration in TSS is required by the tenth calendar day of the month following the goods movement. You do not have to make use of this additional time and can continue to submit your Supplementary Declaration by the fourth working day of the following month if preferred.

TSS will automatically submit a Final Supplementary Declaration on your behalf to HMRC, detailing the number of Supplementary Declarations finalised for a given reporting period.

Customs declarations on the TSS Full Frontier journey

If you are following the TSS Full Frontier journey, you will need to complete a Full Frontier Declaration. This is generally done prior to goods movement, but exact requirements can vary based on your specific journey and mode of transport (for example, air vs maritime). An in-depth overview can be found in the Full Frontier Declarations guide on NICTA.

Things to remember:

- If you are moving goods on the TSS Full Frontier journey, review the Full Frontier Declaration: Step-by-step guide to determine when you need to submit your declaration

- If you are moving goods from GB to NI under special procedures, you should read the Reliefs and Duty Suspension: Overview and considerations for data input in TSS declarations guide before submitting your declaration to check for any specific requirements for your chosen procedure

- If moving goods from GB to NI via IE, you will follow the transit procedure (see TSS Transit service: a step-by-step guide for traders)

- If moving goods from NI to GB (either direct or via IE), review the Movement of Goods from NI to GB: Step-by-step guide

- Some goods, such as those intended for re-export, may be eligible for an oral or by conduct declaration

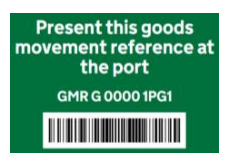

Generating a Goods Movement Reference

Goods Movement Reference (GMR) is a reference number and barcode created pre-movement of goods. A GMR is required for any goods movements that are moving via Roll on Roll off (RoRo). It is the responsibility of the haulier to ensure a GMR is generated for any RoRo movements. A GMR can either be generated within TSS or by using the Goods Vehicle Movement Service (GVMS).

Generating a Goods Movement Reference within TSS

Hauliers or traders who are acting in their own name within their own TSS account can authorise TSS to generate GMRs from an Entry Summary Declaration header record in the TSS Portal instead of doing this separately in GVMS, which may save you time and will ensure all consignments are included.

If generating a GMR within TSS, you will be able to access the corresponding GMR barcode through TSS (see screenshot below), or through your GVMS account via the Government Gateway. For further guidance refer to Create a Goods Movement Reference guide on NICTA

Note: TSS has the functionality for an agent to act on behalf of a trader, but it does prohibit an agent from generating a GMR on behalf of a trader when acting in this capacity.

Generating a Goods Movement Reference using the Goods Vehicle Movement Service

If you are unable to use the TSS automated process for creating a GMR and generating the barcode through TSS, refer to the Creating a Goods Movement Reference guide on NICTA for further guidance on the GVMS system.

Things to remember:

- Ensure you enter the correct reference numbers in GVMS, including the XI EORI number

- Ensure the driver transporting goods has the Goods Movement Reference barcode and knows if the vehicle has been selected for checks. The driver can refer to the GOV.UK service ‘Check if you need to report for an inspection’ for more guidance

- If you’re moving goods via Ireland, for example, using the Dublin port, follow the transit procedure (see TSS Transit service: a step-by-step guide for traders)

- Oral Declarations may also require a Goods Movement Reference (see Oral Declarations: Checklist for traders)

For further information and help:

- Register for the Goods Vehicle Movement Service on GOV.UK

- Read a step-by-step guide on Creating a Goods Movement Reference

- Watch a video on creating a Goods Movement Reference on the Goods Vehicle Movement Service

- Read the TSS Transit service: a step-by-step guide for traders on NICTA to find out more about moving goods via Ireland

Paying duty

Depending on the type of goods you are moving, you may be eligible for schemes to reduce duty payment. Such schemes include UK Internal Market Scheme (UKIMS) authorisation, preferential tariff rates, customs duty waiver, duty relief or customs special procedures.

HMRC will calculate if a duty payment is required for your goods, based on the information in your declaration (either Supplementary Declaration or Full Frontier Declaration).

The importer holds responsibility for checking if any duty payment is necessary.

If duty payment is required, importers (including agents acting as intermediaries) can make any required duty payments on the TSS Portal.

Things to remember:

- If you use the TSS Duty Deferment Account, making payment closes the import process

- If you are using your own Duty Deferment Account, the charge is applied and taken by HMRC via direct debit

- The XI EORI and DDA authorisation(s) references reported in your Company Profile need to be valid, compatible, and updated as per regulation requirements

- If you move goods frequently, consider applying for a Duty Deferment Account and customs comprehensive guarantee, if required

For further information and help:

- Read the Payments: Step-by-step guide using TSS, where you can also check payments deadlines on the payments calendar

- Apply for your own Duty Deferment Account on GOV.UK

- Check the Tariffs on goods movements into NI guide for schemes to reduce duty payments

Haulier checklist: What do I need to know?

| Action | Frequency | |

|---|---|---|

| ❑ | Obtain XI EORI number for your organisation | One-off |

| ❑ | Register for TSS Ensure the authorisations provided are valid and compatible with the XI EORI references populated |

|

| ❑ | Register for the Goods Vehicle Movement Service | |

| ❑ | Obtain Importer's XI EORI number | For every movement |

| ❑ | Obtain exporter’s XI EORI number (if unknown, indicate on form) | |

| ❑ | Prepare journey details including addresses, place(s) of loading and unloading | |

| ❑ | Prepare description of all items you are moving (for example, number of packages, total weight) | |

| ❑ | Identify if you are moving controlled goods to determine relevant documentation | |

| ❑ | Obtain vehicle details | |

| ❑ | Obtain Entry Summary Movement Reference Number and Simplified Frontier Declaration EORI and/or Simplified Frontier Declaration Movement Reference Number

Note: Further guidance on Reference Numbers and the GMR under the Full Frontier Declaration can be found in the Creating a Goods Movement Reference guide and the ‘Full Frontier Declaration’ section of the Data Guide on NICTA |

|

| ❑ | Generate a Goods Movement Reference | |

| ❑ | Have a Goods Movement Reference barcode to hand | |

| ❑ | Prepare for physical and document checks (if selected) - Only for controlled goods |

Importer checklist: What do I need to know?

| Action | Frequency | |

|---|---|---|

| ❑ | Obtain XI EORI number for your organisation | One-off |

| ❑ | Register for TSS Ensure the authorisations provided are valid and compatible with the XI EORI references populated |

|

| ❑ | Check eligibility for the UK Internal Market Scheme (UKIMS) on GOV.UK | |

| ❑ | Check if you can claim a tariff waiver if your goods are ‘at risk’ of moving into the EU or if your goods are eligible for any duty suspensions | |

| ❑ | Understand the rules of origin of your goods (for example, where your goods come from) | For every movement |

| ❑ | Prepare delivery details including addresses, place(s) of loading and unloading | |

| ❑ | Obtain details of your goods (e.g., item mass, package marks, types of package) | |

| ❑ | Determine if goods are 'at risk' | |

| ❑ | Determine if goods constitute 'controlled goods' and provide haulier with information on goods (e.g., licences, certificates) - only for controlled goods | |

| ❑ | Determine which declaration route is required to move goods | |

| ❑ | Identify commodity codes for your goods | |

| ❑ | Determine the procedure codes for your goods | |

| ❑ | Pay duty or other charges, if applicable |

I need to know more

There are additional guides available on NICTA to support you with trade into and out of Northern Ireland:

- ENS Step-by-step guide: Standard Process and Consignment First Process

- Supplementary Declarations: Step-by-step guide

- Full Frontier Declaration: Step-by-step guide

- TSS Transit service: a step-by-step guide for traders

- Movement of Goods from NI to GB: Step-by-step guide

- How to use the TSS Portal

You can also consult the TSS Contact Centre for support on 0800 060 8888.

Changes to guidance and policy

Last updated December 2024.

December 2024: Updated to references of CFSP to SCDP

February 2024: Updated to remove references to UKTS

January 2024: XI EORI validation updates

October 2023: Updated to reflect current status of UKTS and UKIMS

July 2023: Updated to reflect UK Internal Market Scheme (UKIMS) changes.

March 2023: Updated to reflect UCC changes.

December 2022: Updated GMR and GVMS information.

July 2022: Addition of change log.

June 2022: TSS simplified journey flows updated auto-generation of Final Supplementary Declaration as the last step on TSS simplified journey. Changed format of guide from PDF to HTML text.